- Core price increase is strongest in four months.

- Real spending moves slightly higher.

- Real disposable income holds steady along with personal savings rate.

by:Tom Moeller

|in:Economy in Brief

- USA| Jul 31 2025

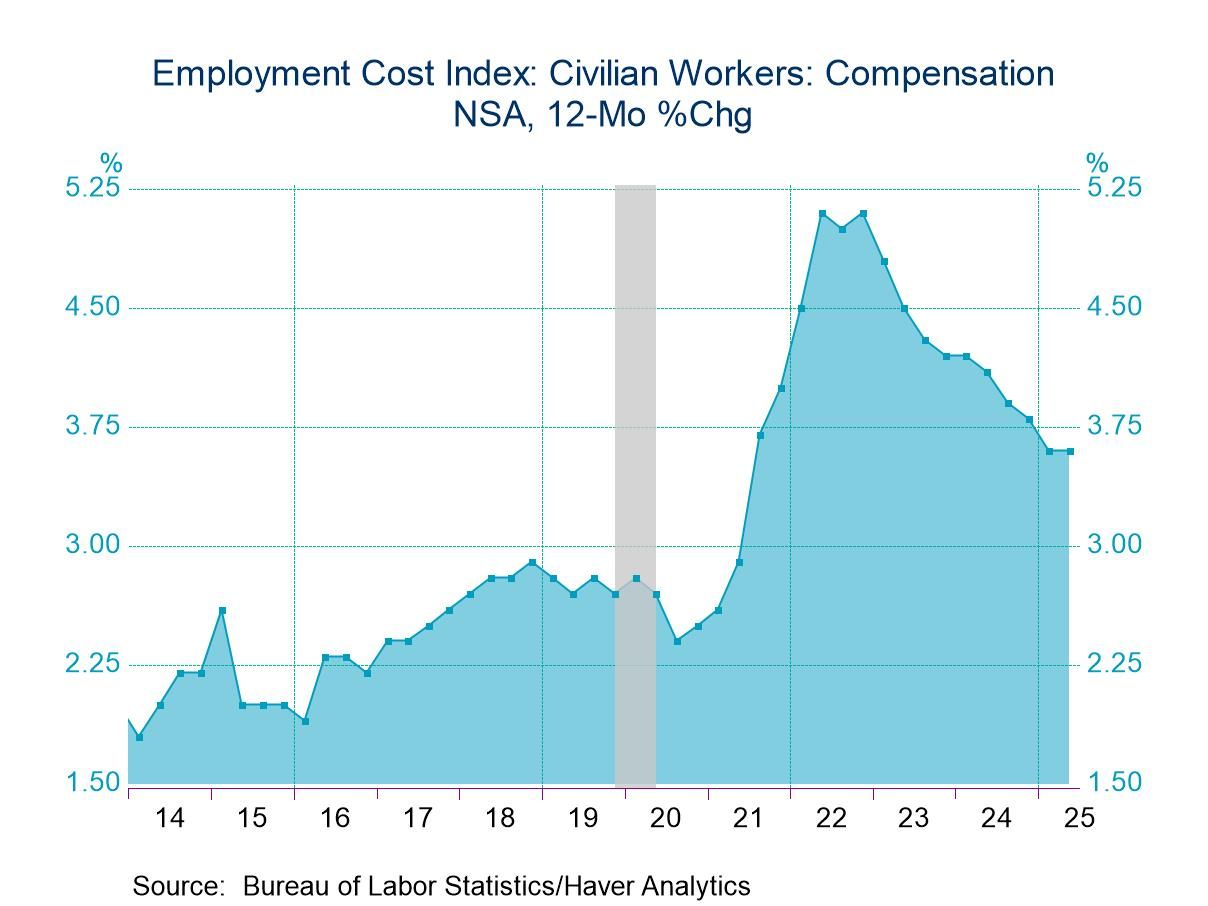

Growth of U.S. Employment Cost Index Unchanged in Q2

- Compensation grew 0.9 q/q in Q2, the same pace as in both Q1 and Q4 2024.

- Wage growth picked up to 1.0% q/q while benefits slowed to 0.7% q/q after Q1 surge.

by:Sandy Batten

|in:Economy in Brief

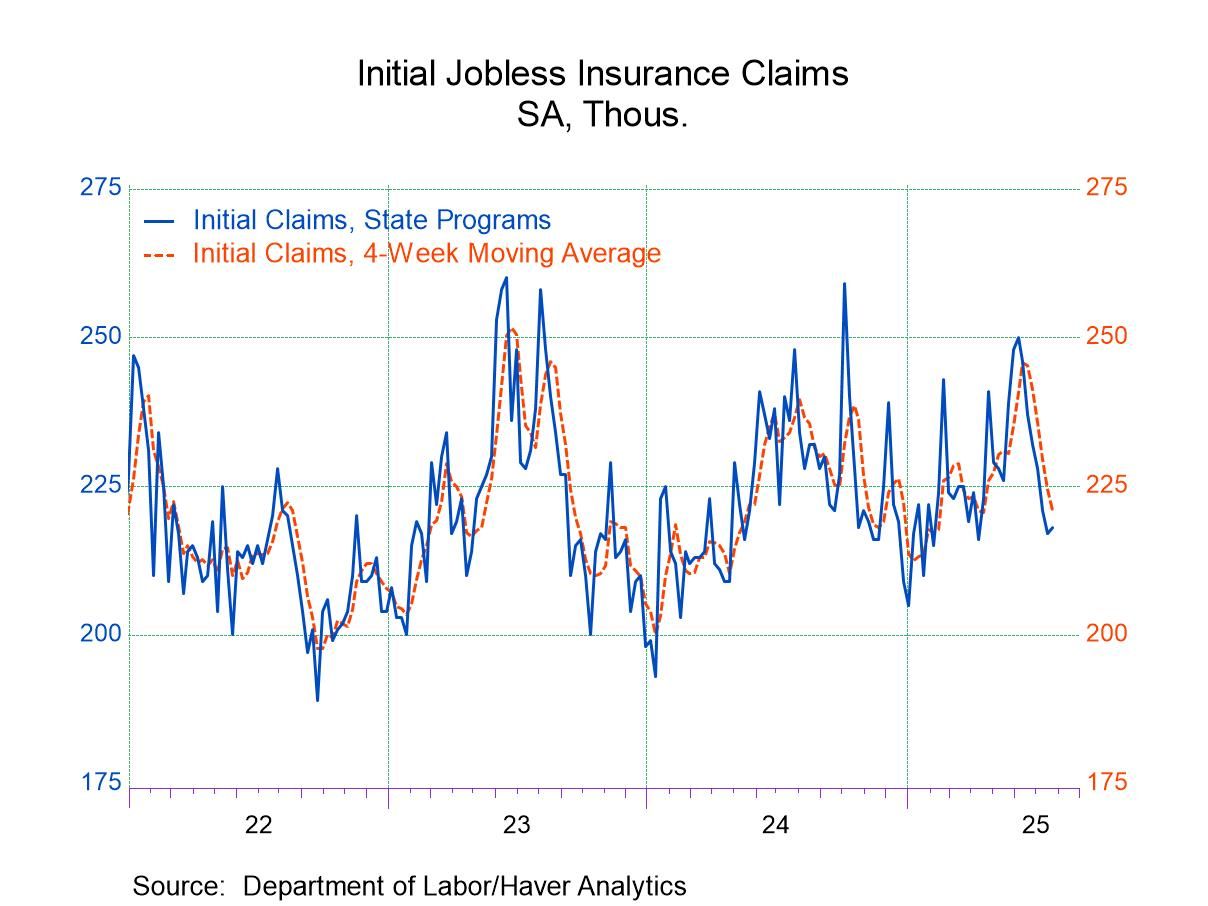

- Initial claims edged up in the July 26 week after six consecutive declines.

- Continuing claims were unchanged in the July 19 week.

- Insured unemployment rate was unchanged for the eighth consecutive week.

- Europe| Jul 31 2025

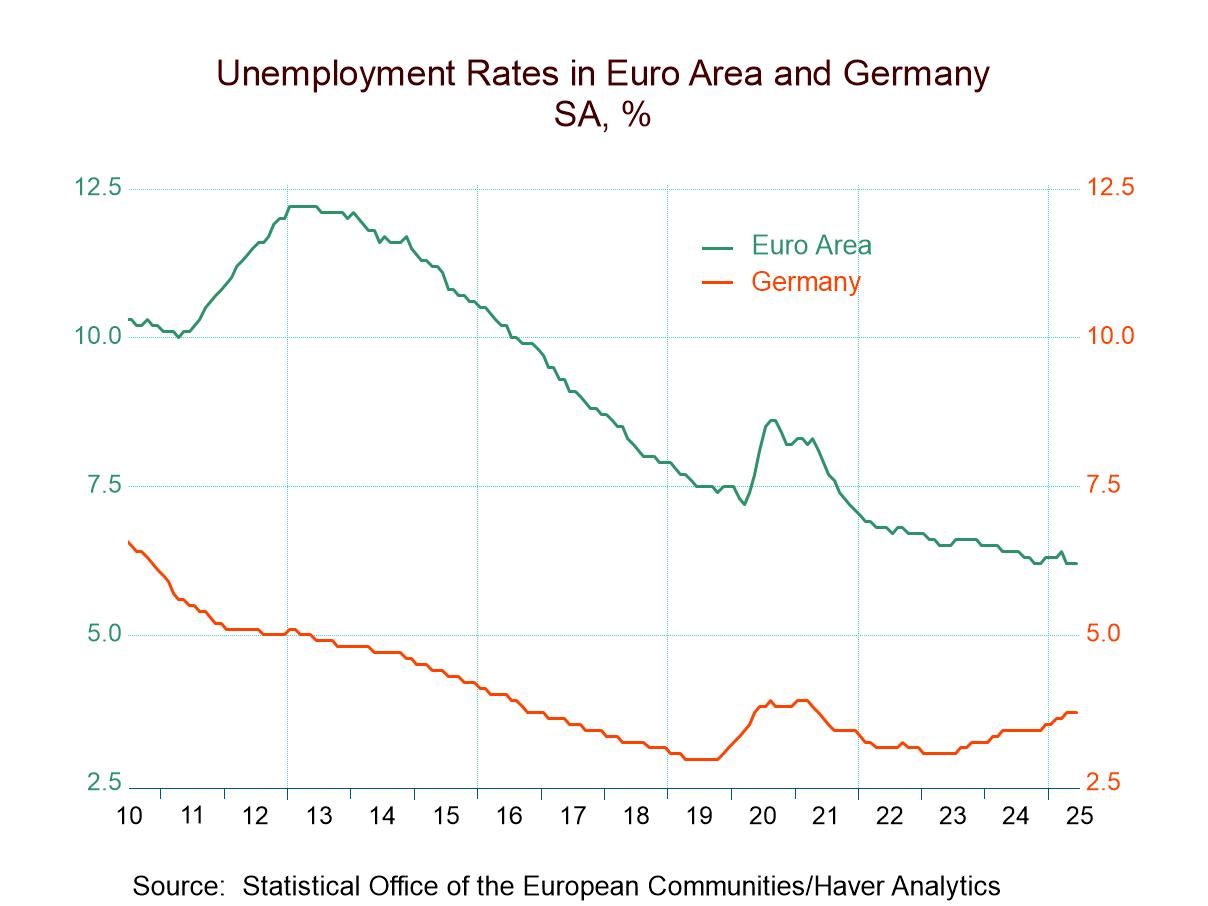

Unemployment in EMU

The overall EMU-wide and EU-wide unemployment rates were steady in June. For the EMU the rate is 6.2% and for the EU the rate is at 5.9%. According to data back to January 2020, the EMU rate has been this low or lower 1.3% of the time while the EU rate has been this low or lower 2.6% of the time. The EU rate at 5.9% is just above its all-time low (of 5.8%) on this horizon while the EMU rate remains at 6.2%, which is its all-time low on this horizon.

In June, four of twelve reporting EMU members logged month-to-month drops in their unemployment rates against only two where unemployment rates rose. This compares to May when seven members reported lower rates of unemployment. In April, nine reported unemployment rate drops.

Sequential data over 12 months, six months and three months show unemployment rates falling in six of 12 EMU members, over all three horizons: three-months, six-months, and twelve-months.

Among the 12 reporting members in the table, only three have unemployment rates above their respective medians since 2000 (rankings above 50%) in this period.

Elsewhere the U.S. unemployment rate fell in the month and was otherwise stable over the past year. The U.K. claimant rate of unemployment has snake higher beginning in May. Japan’s unemployment rate remains anchored at 2.5%. Among these three countries, the U.K. has an unemployment rate above its historic median at 62.7%.

European growth has been slow as the emerging GDP data for 2025-Q2 are confirming. But the labor market in Europe remains very solid. Inflation seems to be winding down in Europe. Europe may even be in for some growth turbulence because of the new U.S. tariff policy. However, for now, the labor market looks quite solid, and growth remains the orders of the day even if it is slow.

- USA| Jul 30 2025

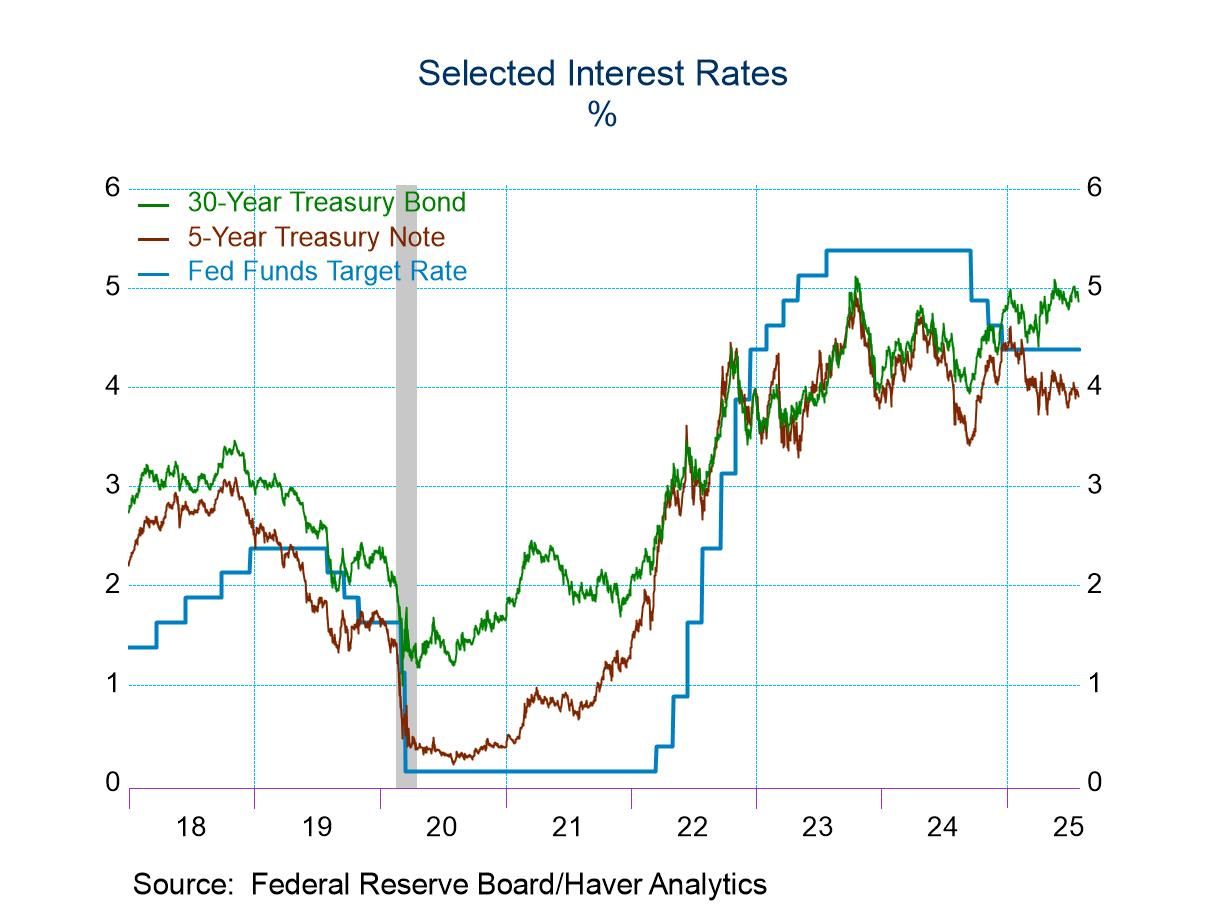

FOMC Targeted Funds Rate Range Is Unchanged

- FOMC holds funds rate target at late-December level.

- Decision was not unanimous with two FOMC members voting for a 25 basis point cut.

by:Tom Moeller

|in:Economy in Brief

- USA| Jul 30 2025

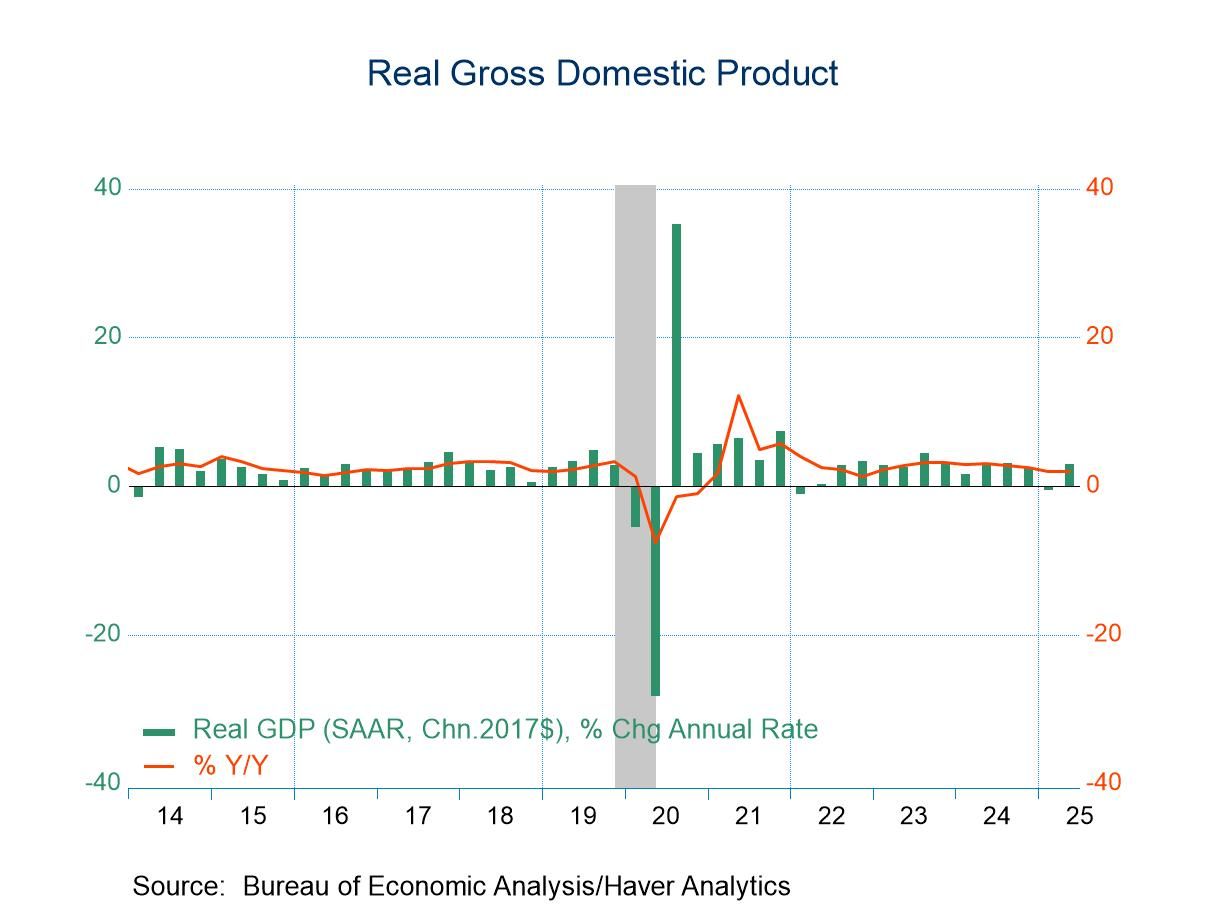

U.S. GDP Q2’25 Shows More Growth, Less Inflation

- Q2 GDP growth more than makes up deterioration in Q1.

- Consumer spending picks up while trade gap deterioration reverses.

- Price index gain roughly halves.

by:Tom Moeller

|in:Economy in Brief

- USA| Jul 30 2025

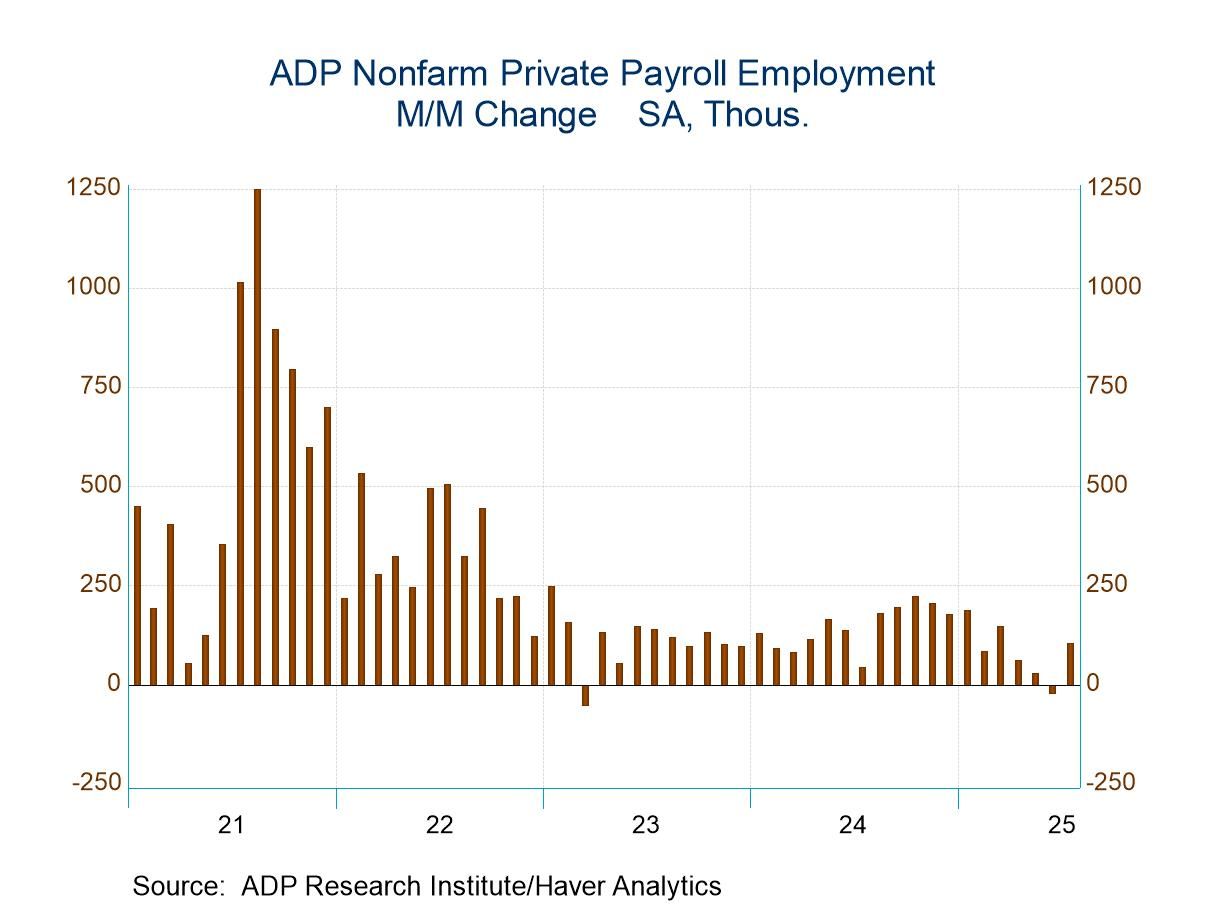

U.S. ADP Employment Rebounds in July

- Private payrolls increased 104,000 in July after a 23,000 decline in June.

- Goods-producing jobs rose 31,000, and service-producing jobs rose 74,000.

- Job stayer wage growth moderated further.

by:Sandy Batten

|in:Economy in Brief

- USA| Jul 30 2025

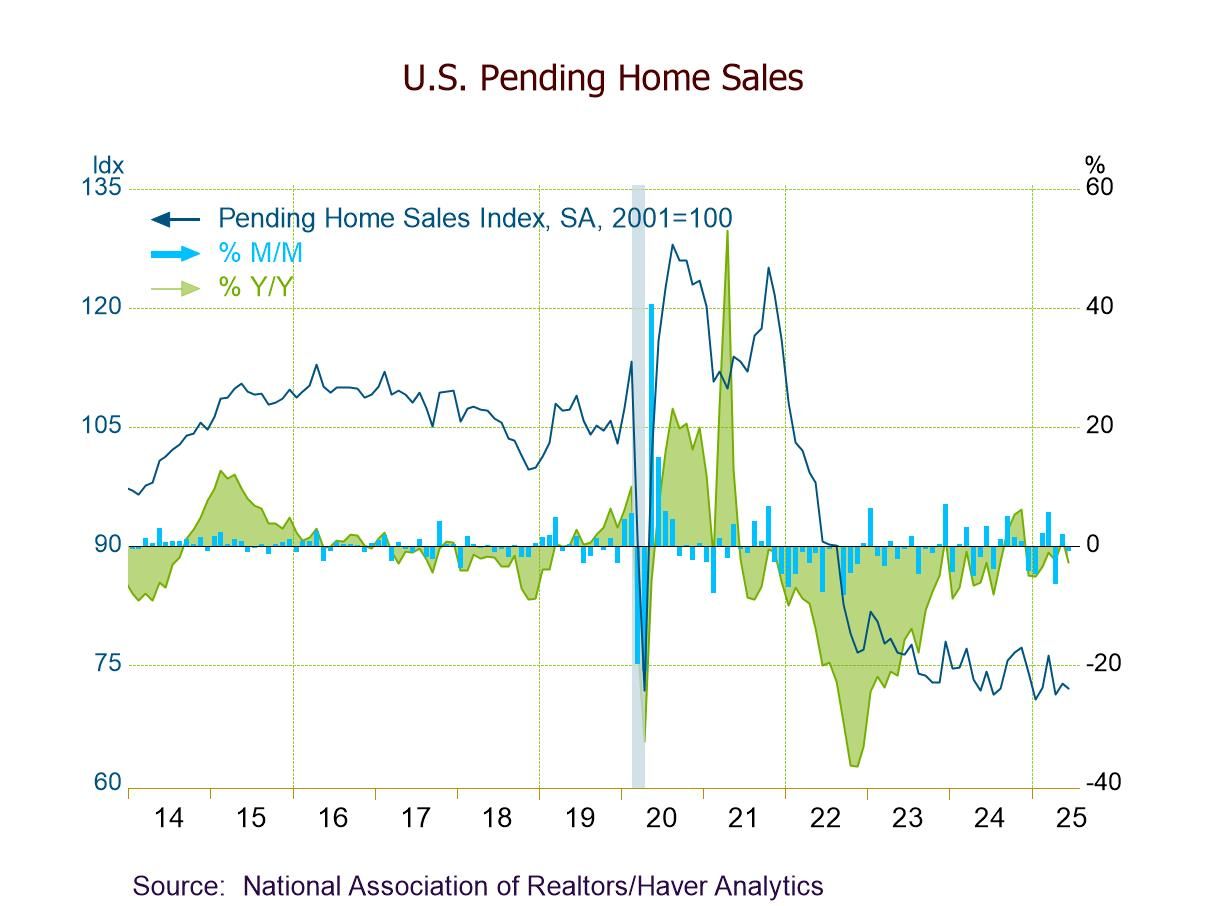

U.S. Pending Home Sales Decline in June

- PHSI -0.8% (-2.8% y/y) in June vs. +1.8% (+1.1% y/y) in May.

- Home sales down m/m in three of four major regions but up m/m in the Northeast (+2.1%).

- Home sales down y/y in the Midwest, South, and West; flat y/y in the Northeast.

- of2693Go to 48 page