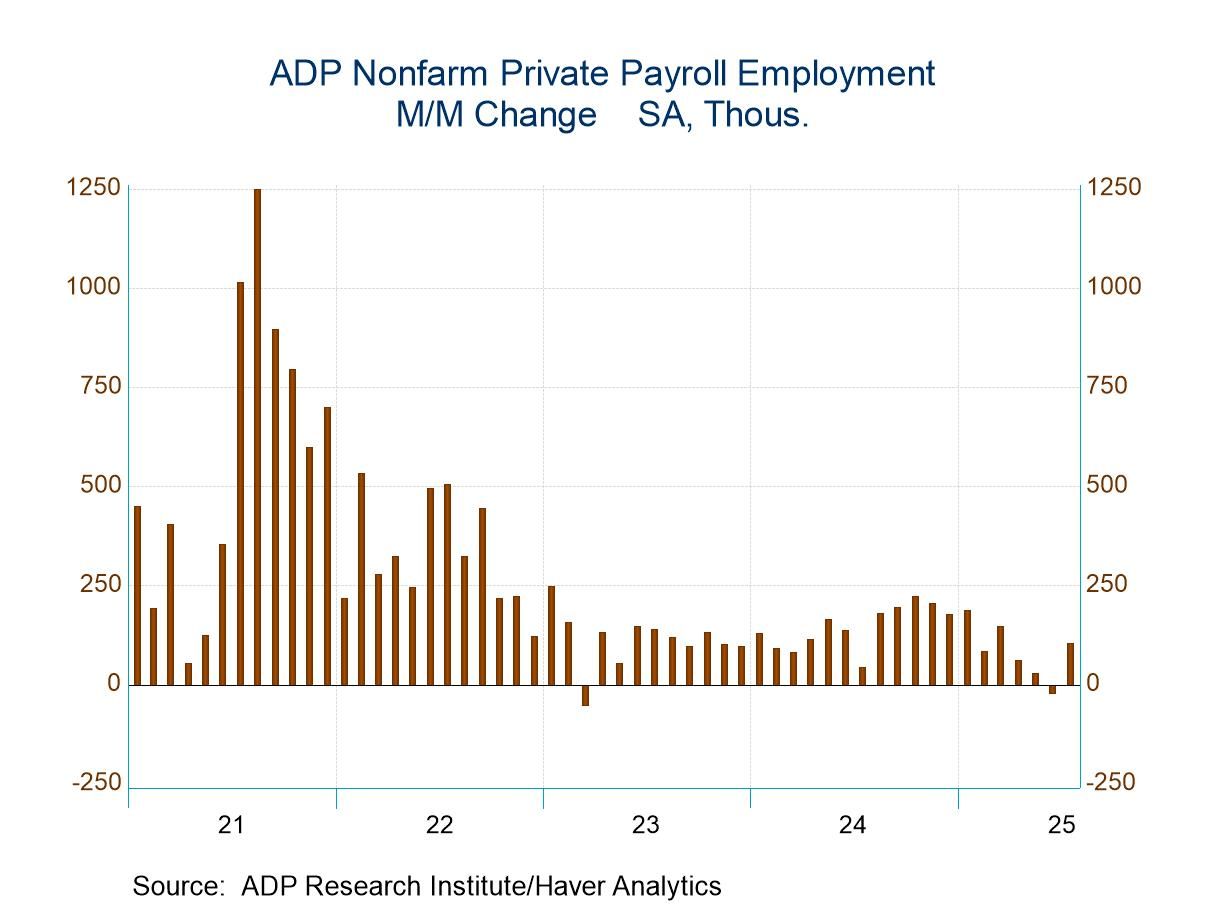

- Private payrolls increased 104,000 in July after a 23,000 decline in June.

- Goods-producing jobs rose 31,000, and service-producing jobs rose 74,000.

- Job stayer wage growth moderated further.

- USA| Jul 30 2025

U.S. ADP Employment Rebounds in July

by:Sandy Batten

|in:Economy in Brief

- USA| Jul 30 2025

U.S. Pending Home Sales Decline in June

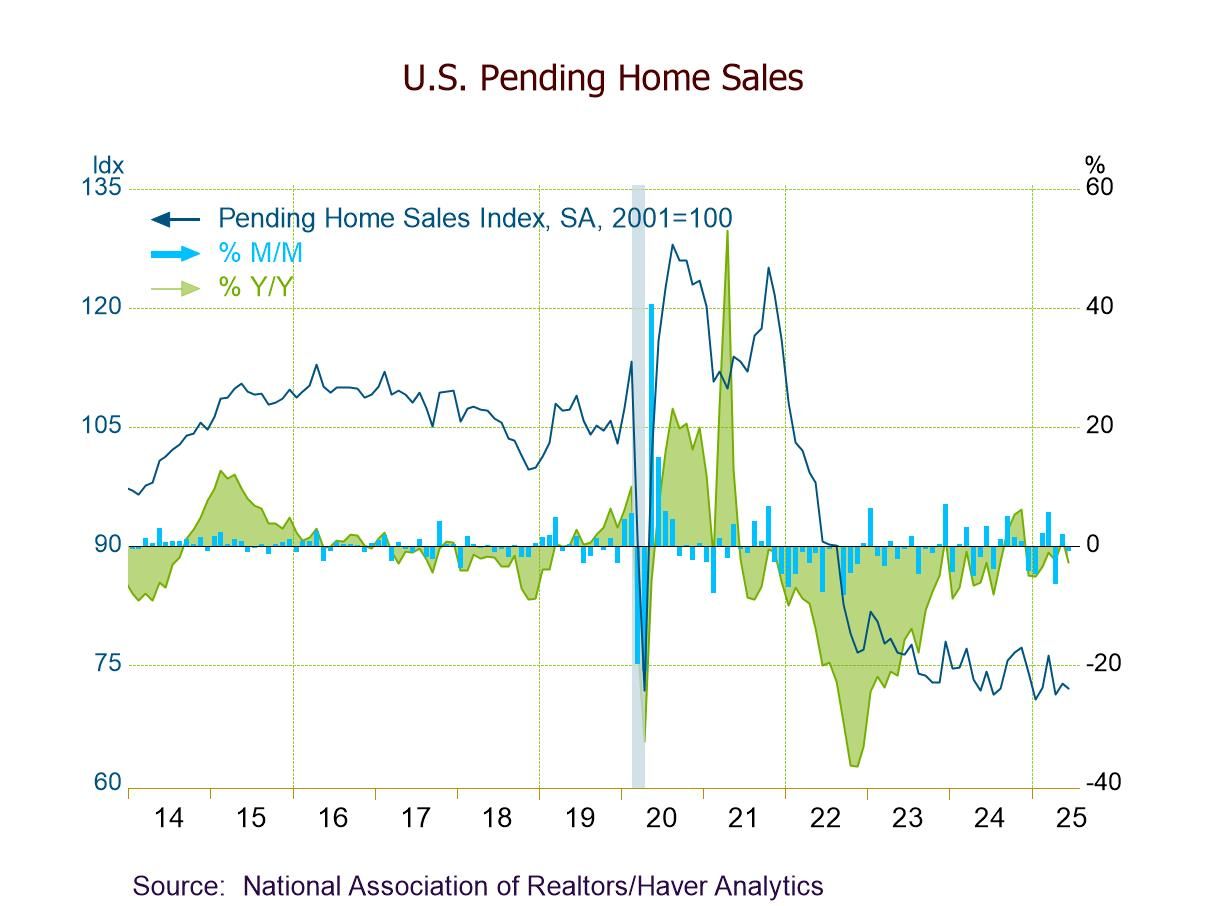

- PHSI -0.8% (-2.8% y/y) in June vs. +1.8% (+1.1% y/y) in May.

- Home sales down m/m in three of four major regions but up m/m in the Northeast (+2.1%).

- Home sales down y/y in the Midwest, South, and West; flat y/y in the Northeast.

- USA| Jul 30 2025

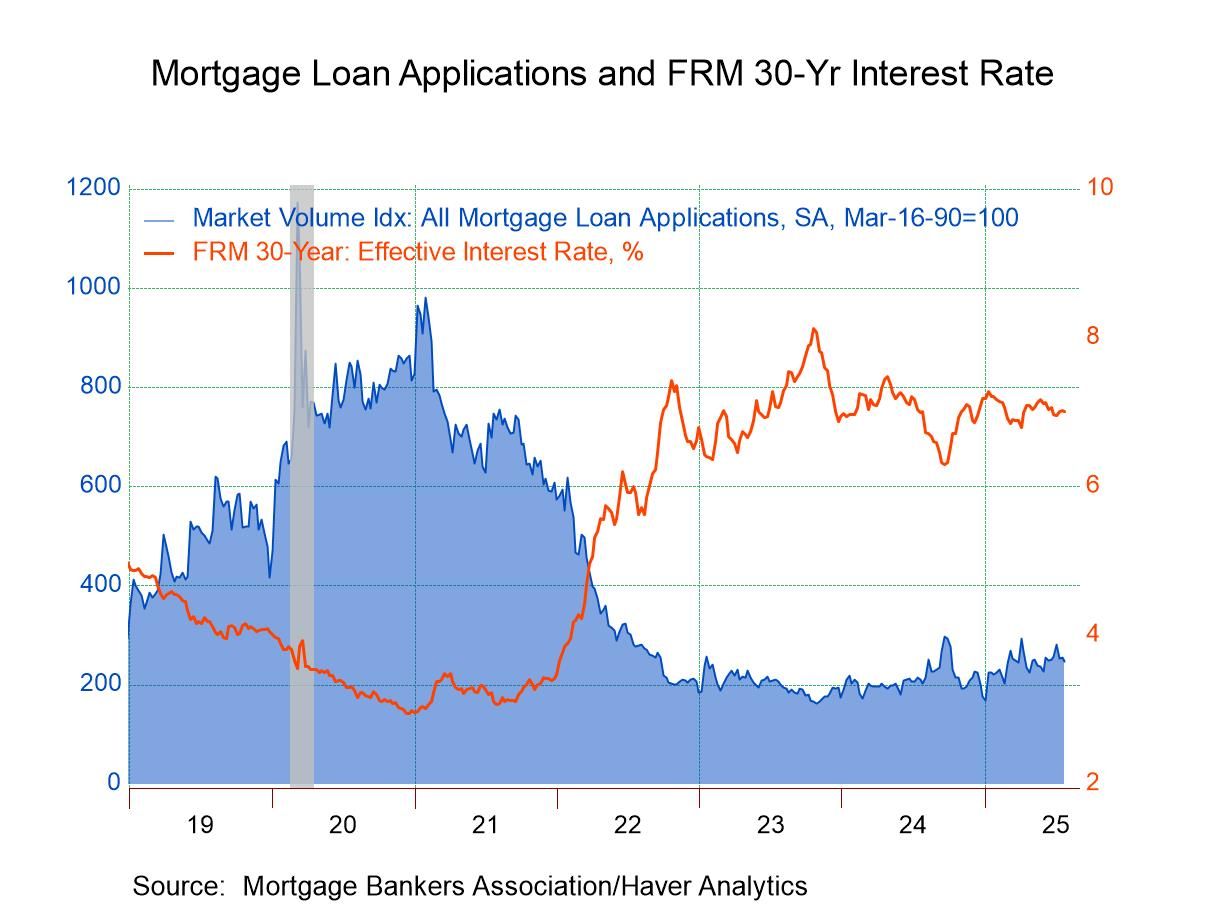

U.S. Mortgage Applications Edged Lower Last Week

- Purchase applications and loan refinancing fell in latest week.

- Effective interest rate on 30-year fixed-rate loan declined minimally.

- Average loan size edged up in latest week.

- Europe| Jul 30 2025

EMU GDP Slows; But It Creeps Ahead at a Slightly Sub-standard Pace

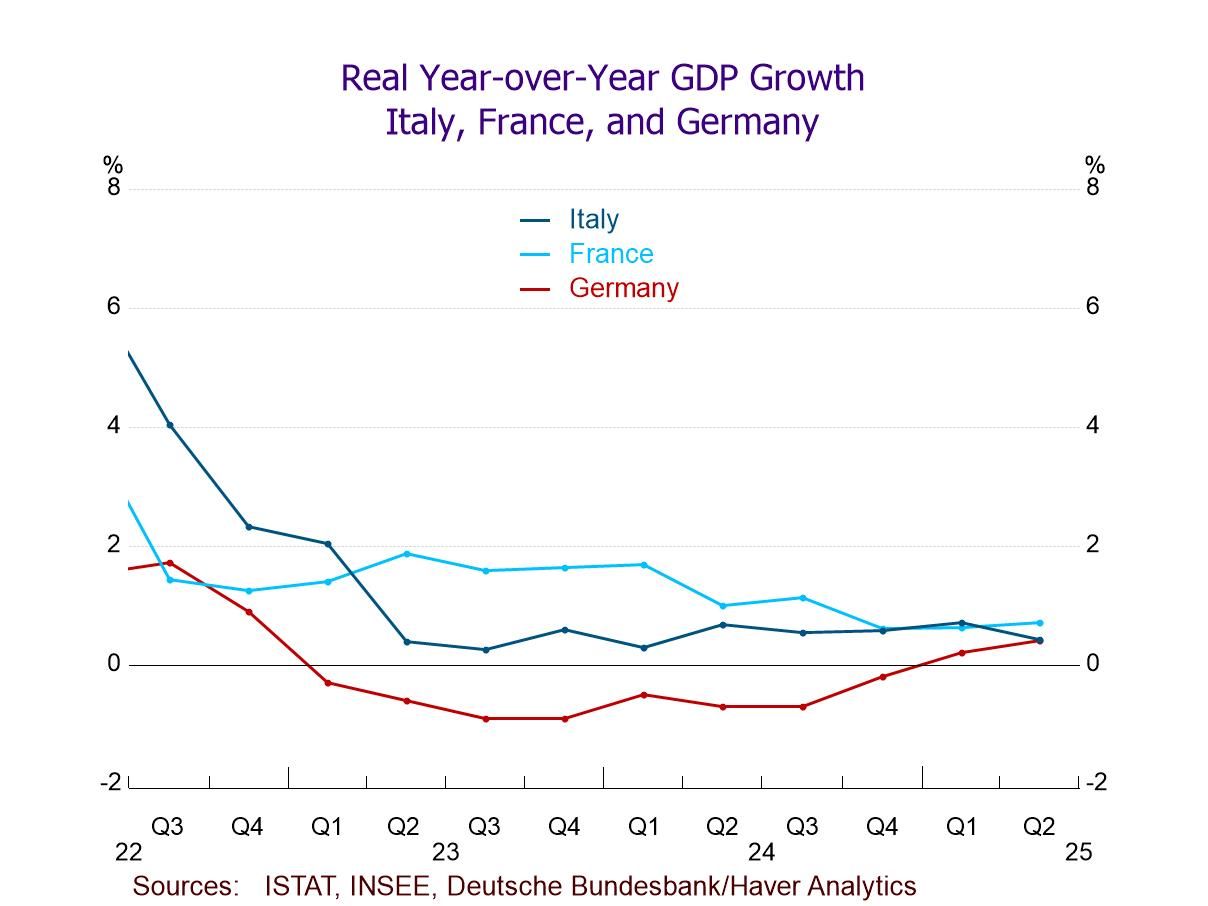

GDP growth in the European Monetary Union slowed to an annual rate of 0.4% in the second quarter of 2025 after logging a very solid 2.3% growth rate in the first quarter. Year-over-year growth has slipped to 1.4% in the second quarter compared to a 1.5% year-over-year pace in the first quarter; however, the second quarter year-over-year growth rate is still a little ahead of the fourth quarter pace in 2024 when it grew by only 1.3% and it is stronger than the third quarter of 2024 when it grew at a 1% pace. While EMU GDP growth has slowed quarter-to-quarter, the year-over-year pace has a moderate ranking. The pace ranked on all growth rates since 1997 leaves the year-over-year pace of 1.4% at a 42.4 percentile standing; that's below its median for the period (the median occurs at a ranking of 50%). However, it's not that short of the median and it indicates that growth is moderately slower than it's been over the past period back to 1997.

Growth by Size The Four Largest: The four largest economies in the monetary union grew at a 0.5% annual rate in the second quarter, compared to 1.2% in the first quarter and 0.8% in the fourth quarter of 2024. The four largest EMU economies (Germany, France, Italy, and Spain) have GDP-weighted growth of 0.8% over four quarters, the same as in Q1. That growth rate ranks in its 37th percentile, well below its median pace since 1997.

The Rest: The ‘rest of EMU’ grew at a ‘technically positive’ annual rate of 0.1% in 2025-Q2. That slow-crawl is quite weak, but it follows a 5.3% pace in Q1. The rest of EMU grows at a very solid 3% pace year-over-year in 2025-Q2 and logs 3.0% or better growth rates for three quarters in a row. The year-over-year pace ranks in the top one-third of all growth rates for the rest of EMU group since 1997-Q4. While the Q2 pace is very slow, in context, it does not seem to be an issue.

EMU Median Growth: The median growth rate for all of EMU is considerably weaker overall than the growth for the Rest of EMU. In 2025-Q2, however, the median pace is 0.7%, down from 1.1% in Q1. The year-on-year pace over the past four quarters for the EMU has been gradually slowing and is at 1.1% year-over-year pace in 2025-Q2. That growth rate for all of EMU is weaker than the ranking for the large countries as well as for the rest of EMU.

Compared to the U.S. Growth in the U.S. jumped to 3% in Q2 and logged a year-on-year pace of 2.0%. The U.S. logs the third strongest year-on-year pace in the table for Q2. Still, compared to its own historic experience, the U.S. growth rate ranks poorly in its 31.8 percentile, the lower third of its historic queue of growth rates. In relative terms, only two EMU member countries in the table rank lower.

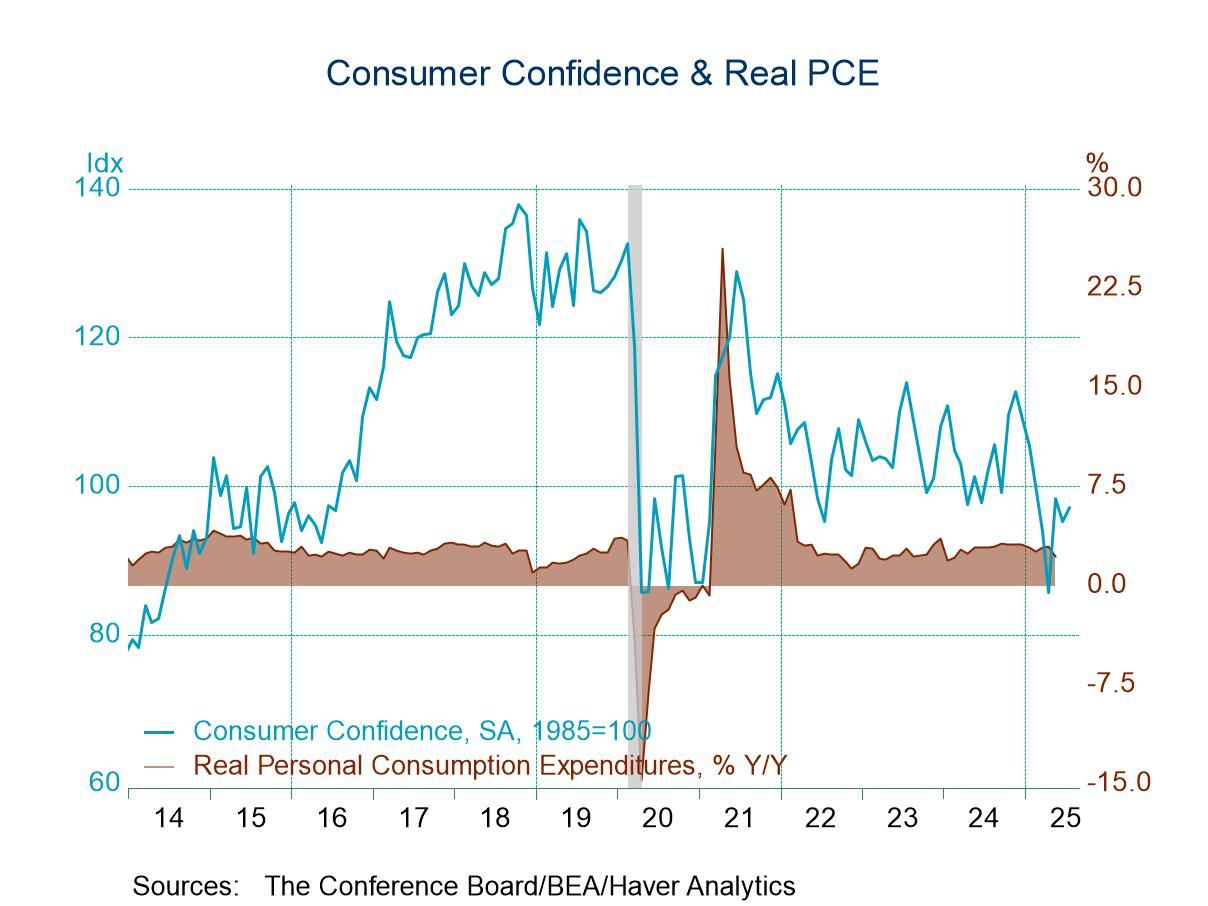

- Decline reverses much of June decline.

- Expectations improve but present situation reading declines.

- Inflation expectations edge down.

by:Tom Moeller

|in:Economy in Brief

- USA| Jul 29 2025

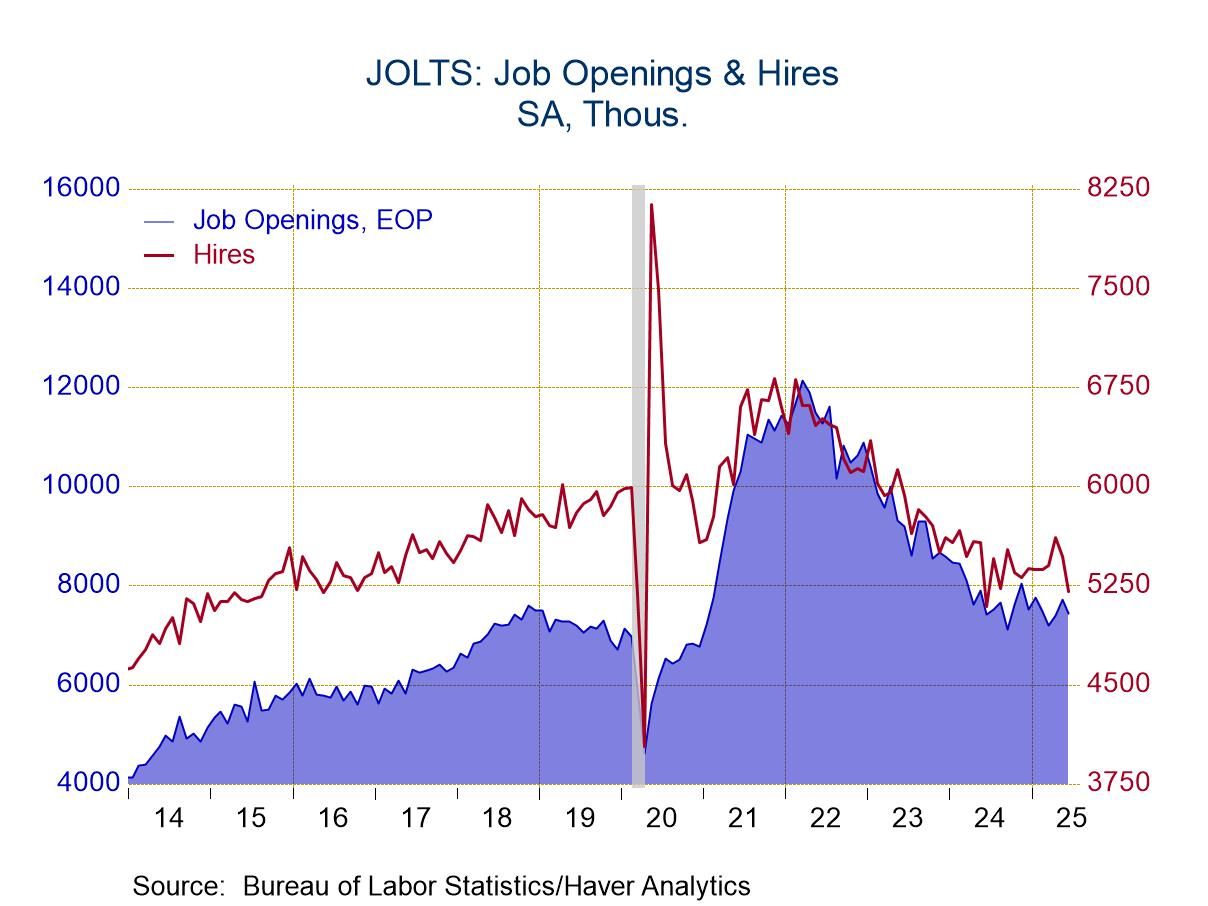

U.S. JOLTS—Openings and Hiring Slid in June

- Job openings fell 275,000 in June after having risen in each of the previous two months.

- Hiring fell 261,000, the largest monthly decline since June 2024.

- Separations fell 153,000, led by a 128,000 decline in quits.

- Layoffs edged down 7,000, the third monthly decline in the past four months.

by:Sandy Batten

|in:Economy in Brief

- USA| Jul 29 2025

U.S. Goods Trade Deficit Unexpectedly Narrows in June

- Deficit: $85.99 bil. in June, smaller than $96.42 in May.

- Exports -0.6%, down for the second straight month, led by an 8.1% decline in exports of industrial supplies & materials.

- Imports -4.2%, down for the fourth month in five, led by a 12.4% drop in nonauto consumer goods imports.

- USA| Jul 29 2025

U.S. FHFA House Prices Fall Further in May

- Prices edge lower m/m.

- Annual increase moves to two-year low.

- Price changes are uneven amongst regions.

by:Tom Moeller

|in:Economy in Brief

- of2700Go to 56 page