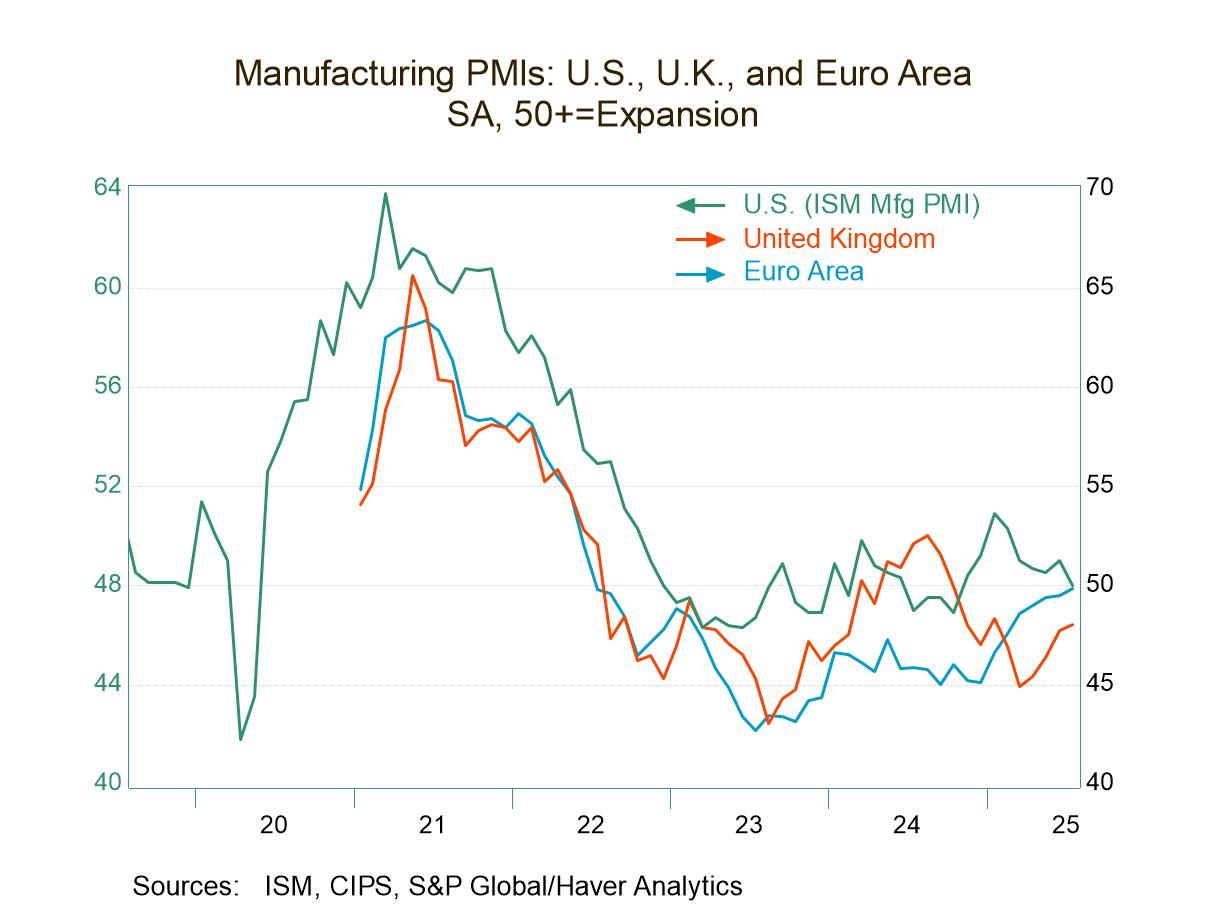

Manufacturing PMIs in the S&P framework were mixed in July. However, the median reading edged slightly higher rising to 48.6 in July from 48.5 in June. But both of these are significantly weaker than the 49.1 reading in May. Manufacturing continues to post PMI readings that are below 50 indicating sector contraction on a fairly broad basis in July among the 17 reporting countries in the table plus the euro area. Only India and Vietnam reported PMI readings above 50 indicating sector expansion in July. In June, three of these jurisdictions showed readings above 50; in May, only three had readings above 50 as well. It remains a difficult time for manufacturing globally.

The readings for the manufacturing PMIs also show slippage in the medians from 12-months to six-months to three-months. The 12-month median is 49.2, the six-month median at 48.8, and the three-month median at 48.7. The bottom line is that most manufacturing sectors show contraction, and the contractions are generally getting slightly worse.

However, on an individual basis over three months about two-thirds of the reporters showed an improvement. Over six months just under 40% showed improvement and over a year about 44% of them showed improvement compared to the year before. Only the three-month versus six-month comparison shows a majority of reporters indicating better performance in July.

The ranked or queue standings metrics that place these individual readings for July in their queue of data over the last 4 ½ years, show standings above 50% which put the individual readings above their medians for this period. And only six of these eighteen reporting jurisdictions sported readings above 50%. Those were for the euro area, Germany, France, and India. India has a rating well above 50% at its 96th percentile; Malaysia has a reading above 50% and Vietnam has a reading well above 50% at its 74th percentile.

Global

Global