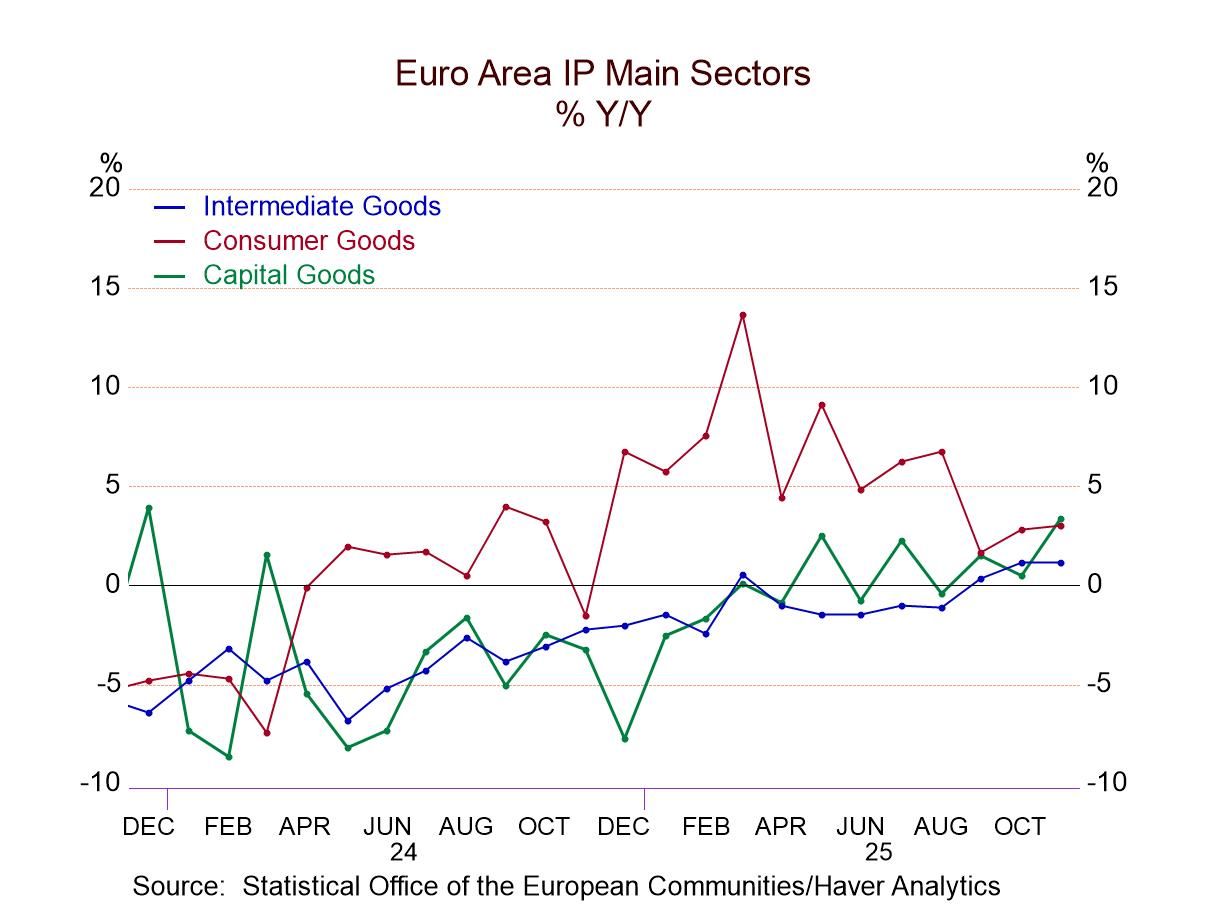

Industrial output in the European monetary union rose by 0.7% in November for the second month in a row. Manufacturing output jumped to an increase of 0.9% after rising by 0.3% in October. By sector, output in consumer goods fell by 0.8%, as consumer durables output fell by 1.3%, and consumer nondurables output fell by 0.6%. However, intermediate goods output rose by 0.3% and capital goods output rose by 2.8%.

Sequential trends Sequentially output in the euro area is looking much stronger with the 2.6% gain over 12 months, a 1.2% annual rate gain over six months and at a smashing 7.1% annual rate gain over three months. For manufacturing, the 12-month pace is 12.5%, the rate of change over six months is 0.4% at an annual rate, while over three months, manufacturing output is rising at a 4.1% annual rate.

Component growth Component growth is mixed with consumer goods output overall showing negative growth rates over three months and six months, consumer durables transition from declining growth to positive growth over three months while consumer nondurables show positive growth over 12 months, transitioning to progressively weaker six-month and three-month rates of growth. Intermediate goods, however, show acceleration in train with three-month growth at 6%, up from 1.1% over 12 months, and with capital goods output progressively rising from 3.3% over 12 months, to a 14.5% annual rate over three months.

Quarter-to-date results Today's report is through November; quarter-to-date industrial production is up at a 4.4% annual rate, with manufacturing up at 1.4% annual rate. The total industrial production growth rate has the historic ranking in its 65.5 percentile and manufacturing growth only ranks at its 55th percentile. Only two sectors, consumer durables, and (barely for) intermediate goods are the growth rates below their historic medians which means their rankings are below their respective 50th percentiles.

Country level trends Across countries we still see a great deal of weakness with the median EMU reporter showing an output decline of 0.1%. However, Germany has progressed to show a 2.1% increase in November and has logged three straight months of output increases of over 1%. For Germany the 12-month, to six-month, to three-month growth rates have progressed from an annual rate of 1.2%, to 3.9% over six months, to a 22.1% annual rate over three months.

Mixed results monthly To be sure, there are more outsized declines across countries than there are increases. Spain posts an 8.5% output decline on the month. Luxembourg posts a 6.9% decline, with Greece and Portugal each logging declines of 3%; however, in all these cases, these negative growth rates in November are reversing or blunting positive growth rates in October. Countries logging strong growth rates in November are Germany at 2.1%, Italy at 1.1%, and Ireland at 1.4%. Outside of the monetary union, Sweden has a gain of 6% and Norway a month-to-month gain of 3.2%. Germany, Italy, Greece, and Sweden exhibit accelerating growth from 12-months to six-months, to three-months. Luxembourg and Ireland exhibit steadily decelerating growth.

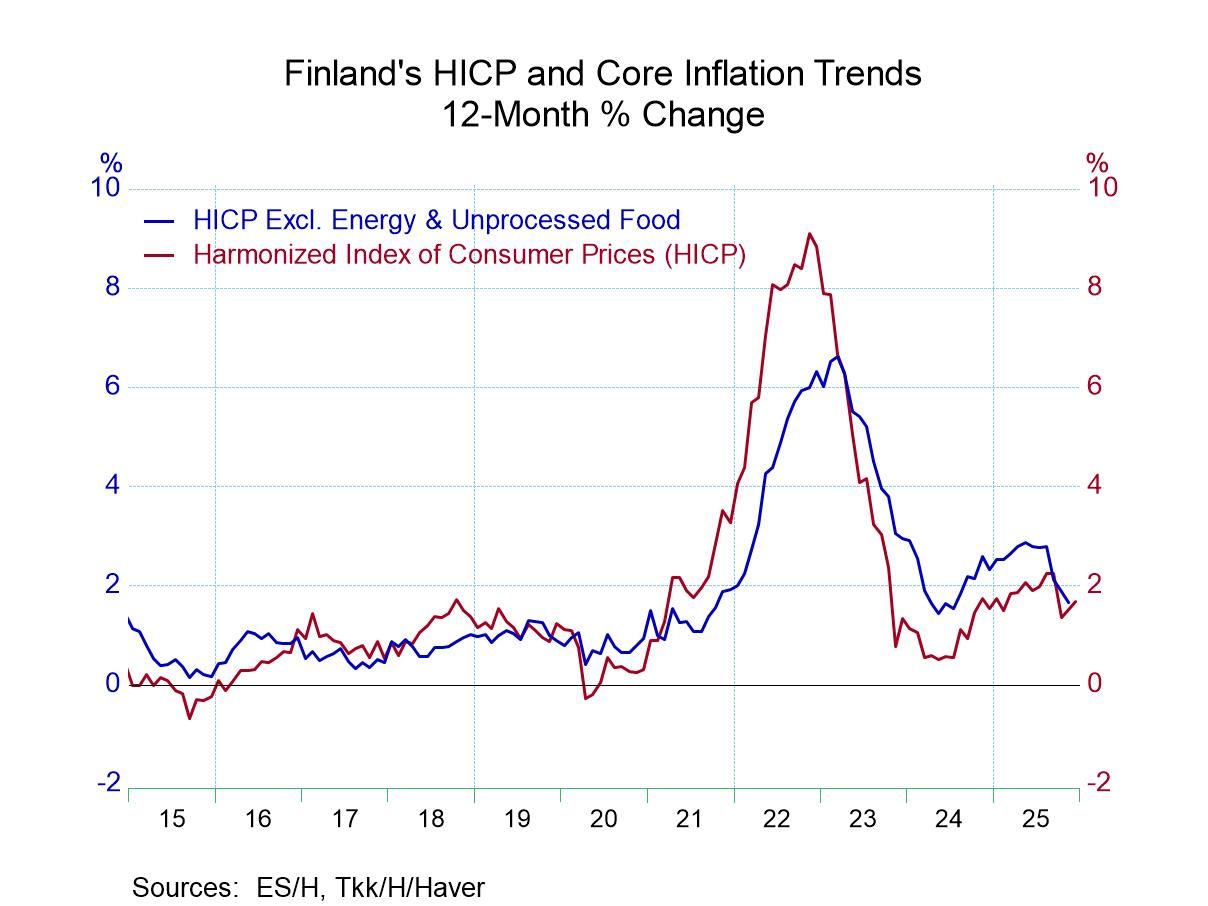

Stronger results on balance sequentially Output growth rates over 12 months, six months, and three months, across monetary union members show over half of them accelerating over the sequential span within the last year. Monthly data from the monetary union and other European reporters remain somewhat inconsistent; however, it's also true we're coming off a very strong October and so the weak monthly November numbers may not be very meaningful. However, this is still leaving us with what are essentially very strong sequential growth rates, from 12-months to six-months to three-months across this group of countries. On a quarter-to-date basis among the 14 countries in the table, only three are reporting quarter-to-date declines in output in progress. Year-over-year growth rates for these countries show standings below their 50th percentile for only four of them, and for Finland the reading is only technically below 50% at 49.6%.

There's a reasonable case being made for the notion that the European Monetary Union is embarking on a revival especially because it seems to be underpinned by Germany which is showing a very strong last three months, very strong sequential growth rates and has logged in addition to this a firm GDP growth rate, after wallowing in recession.