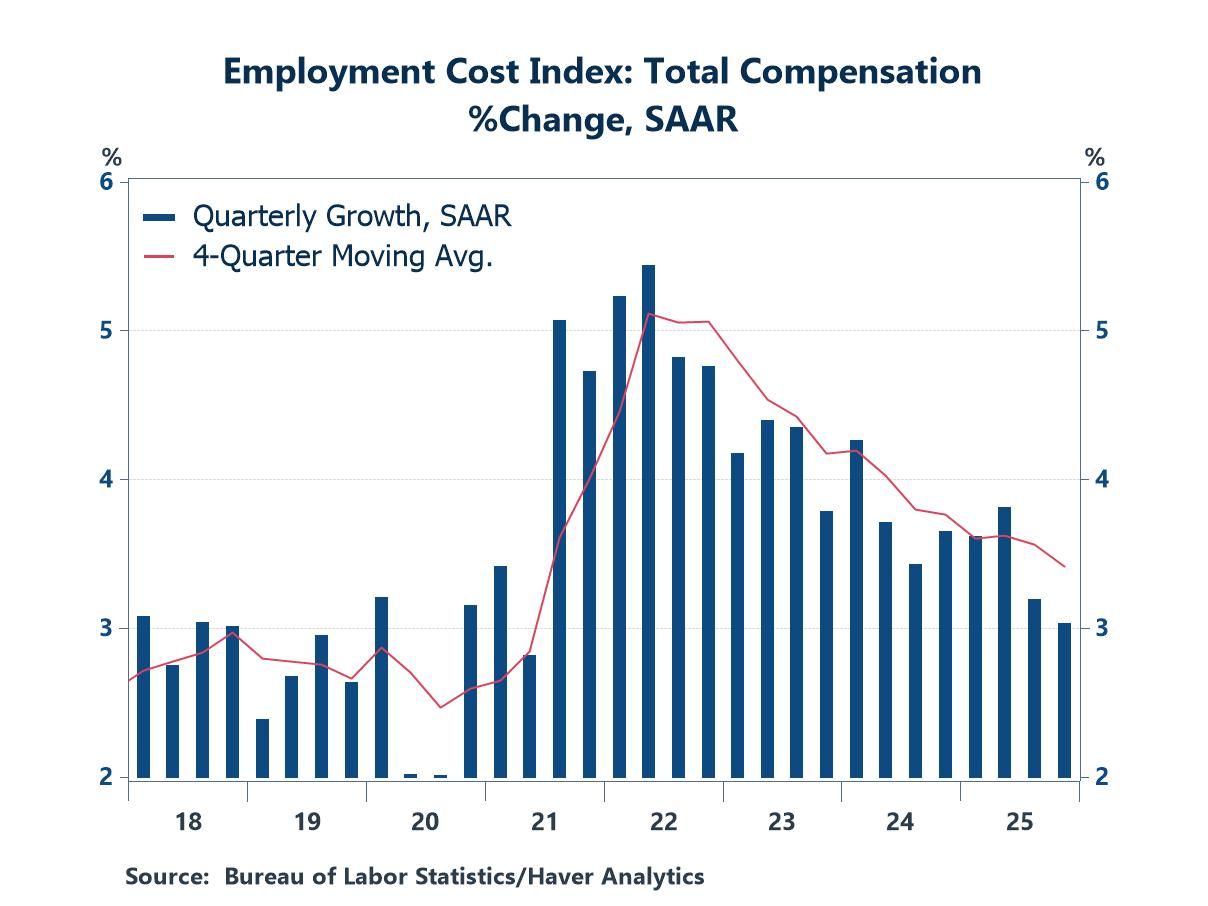

- Vigorous growth during the pandemic-related recovery gives way to moderate advances recently.

- Labor costs seem in line with the Fed’s inflation target.

- USA| Feb 10 2026

Employment Cost Index: Continued Deceleration

- Europe| Feb 10 2026

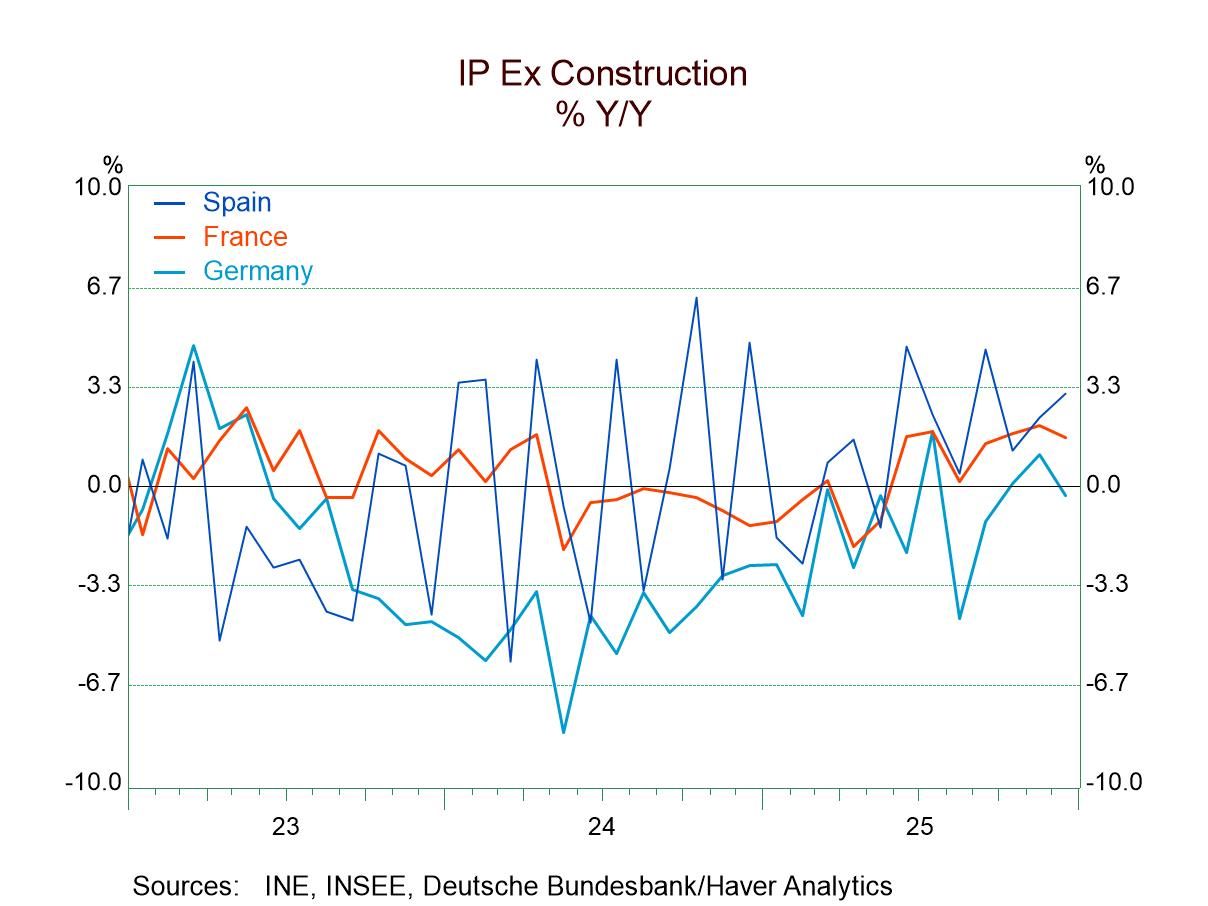

IP in Europe Shows Lethargy

In December, among ten reporting monetary union members, output increased for six of them and declined in four of them. In addition, two reporting European economies, Sweden and Norway, each showed increases in output in December. In November, five monetary union members showed decreases, while only two showed declines in October. The recent trends and data on industrial production are not exactly friendly, but neither are they scathing results. In December, the median change in the monetary union was a 0.1% increase in manufacturing output following a 0.9% median drop in November and a 0.3% median increase in October.

For the full set of reporting countries, 60% showed acceleration in December, about the same as in October. However, in November only 23% showed output accelerating on a month-to-month basis. Coupled with weak median results, the recent reports on industrial production are not particularly impressive.

Sequential results, looking at 12-month, to 6-month to 3-month growth rates, are disappointing as well. The 12-month growth rate puts the annualized median rise of manufacturing output at 2.2%, the 6-month annualized growth rate at -2%, and the 3-month growth rate at -2% for EMU member countries. For the full sample of countries, there is acceleration in 50% over 12 months, 61.5% of them over six months, and that drops down to 38.5% over three months.

In addition, these sequential data show that five reporting countries have persistent decelerations in output growth rates from 12-months to 6-months to 4-months. Those countries include France, the Netherlands, Spain, Greece, and Portugal. However, there are contrary accelerating trends in three reporting countries Malta, Sweden, and Norway; the latter two, of course, are not monetary union members but have various affiliations with the European trading bloc.

Quarter-to-date data (covering the completed fourth quarter) for the full sample show that five countries have output declining on balance in Q4. However, among monetary union members, the median change in the quarter is an annual rate of 1.1% increase in manufacturing industrial production.

Assessing the growth rates based on year-over-year growth in industrial output, only four countries in the sample have output growth rates below their historic medians on data back to 2006. Those are Austria, Germany, Luxembourg, and Malta. Other reporters have growth rates that rank above the 50% mark which puts them above their historic median. Sweden has a year-over-year growth rate in its 93.7 percentile; Norway has a growth rate in its 85.3 percentile; Greece, Portugal, and France have growth rates in their 70th percentiles, respectively.

The December news is not upbeat, but it is not dismal either. It suggests the same old industrial slog is still underway in Europe.

Asia| Feb 10 2026

Asia| Feb 10 2026Economic Letter from Asia: Of Ballots and Bots

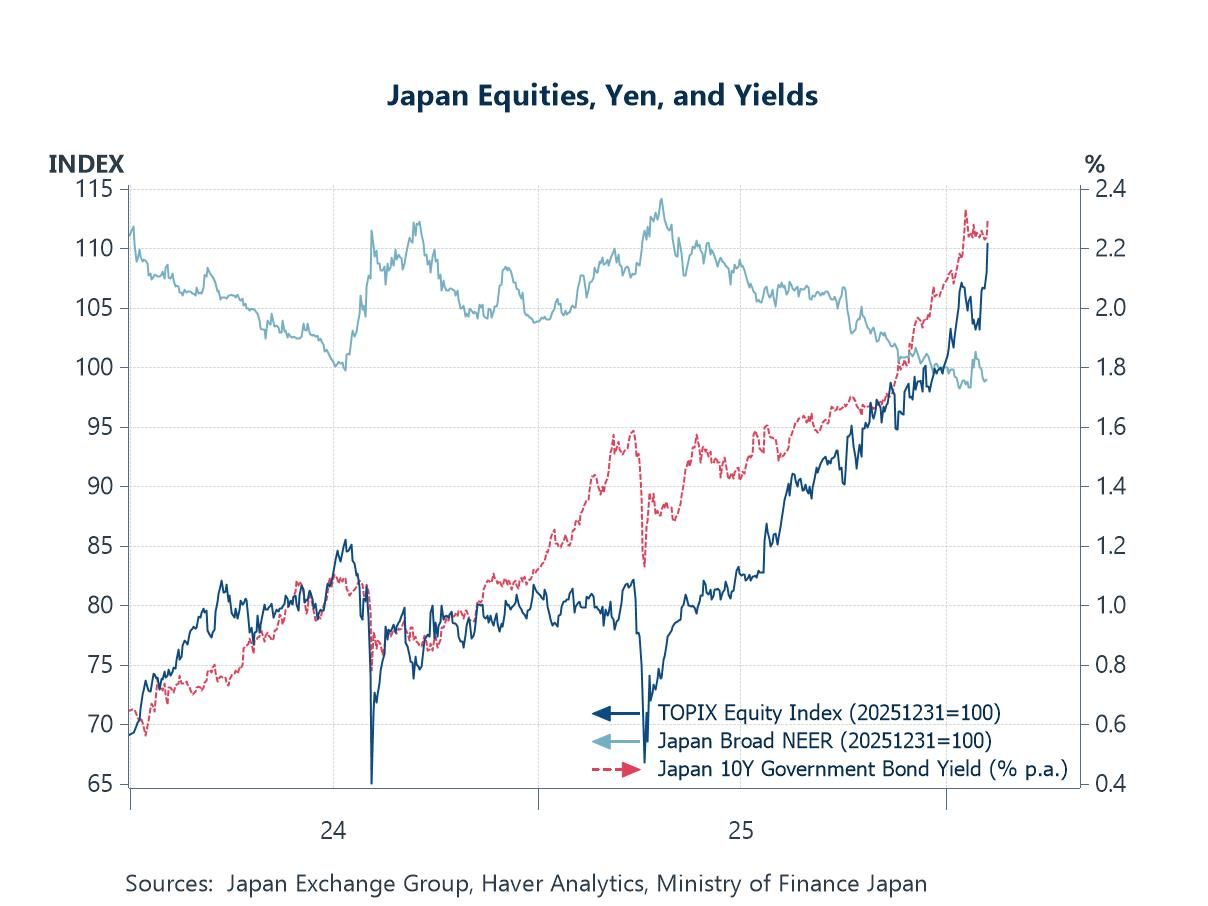

In our Letter this week, we explore Asia in two parts. The first reviews key developments from the past week, focusing on snap election outcomes in Japan (chart 1) and Thailand (chart 2), both of which delivered victories for incumbent parties and helped reduce near-term political uncertainty.

The second, and larger, section builds on last week’s discussion of Asia and AI, shifting the focus to AI’s potential impact on the region from an end-user perspective. On the upside, Asia stands to benefit meaningfully from the eventual large-scale adoption of AI-powered robotics, reflecting the region’s relatively high share of manufacturing value added (chart 3). That said, important considerations remain, including the cost viability of transitioning towards humanoid robotics given the sizeable upfront capital expenditure involved. Beyond manufacturing, AI adoption could also deliver gains in healthcare, particularly as many Asian economies grapple with ageing populations—implying a growing care burden alongside a shrinking domestic caregiver base (chart 4). However, regulatory, ethical, and implementation challenges persist.

At the same time, the AI transition will likely displace certain jobs, making this a race not only of adoption but of adaptability, where education—while an imperfect proxy—offers some insight into which economies may be better positioned to adjust (chart 5). Finally, bureaucratic frictions also matter (chart 6), although even traditionally more bureaucratic economies have begun introducing fast-track frameworks to avoid falling behind in what could prove to be a pivotal transition reshaping the regional, and potentially global, economic landscape.

Japan’s snap election Following a snap election held on Sunday, Japanese Prime Minister Takaichi’s Liberal Democratic Party (LDP) secured a historic landslide victory, winning a more than two-thirds majority in Japan’s 456-seat Lower House. The LDP’s coalition partner, the Japan Innovation Party, also expanded its presence to 36 seats. The outcome suggests that Takaichi’s political gamble to capitalise on strong opinion polling has paid off. While the election result has removed a key source of near-term political uncertainty for Japan, attention now turns to the policy agenda enabled by the government’s newly strengthened mandate. Among the first expected moves, Takaichi appears set to proceed with a temporary food tax pause, reducing the 8% consumption tax on food to 0% for two years. This proposal reinforces the perception that her policy stance is fiscally accommodative, even as critics raise concerns around fiscal discipline and long-term sustainability. As for the market reaction, Japanese equities rallied on stimulus expectations, bond yields rose on prospects of increased issuance to fund higher spending, while the yen recorded only muted net moves (chart 1)—prompting some speculation that some intervention may have taken place.

- Japan| Feb 09 2026

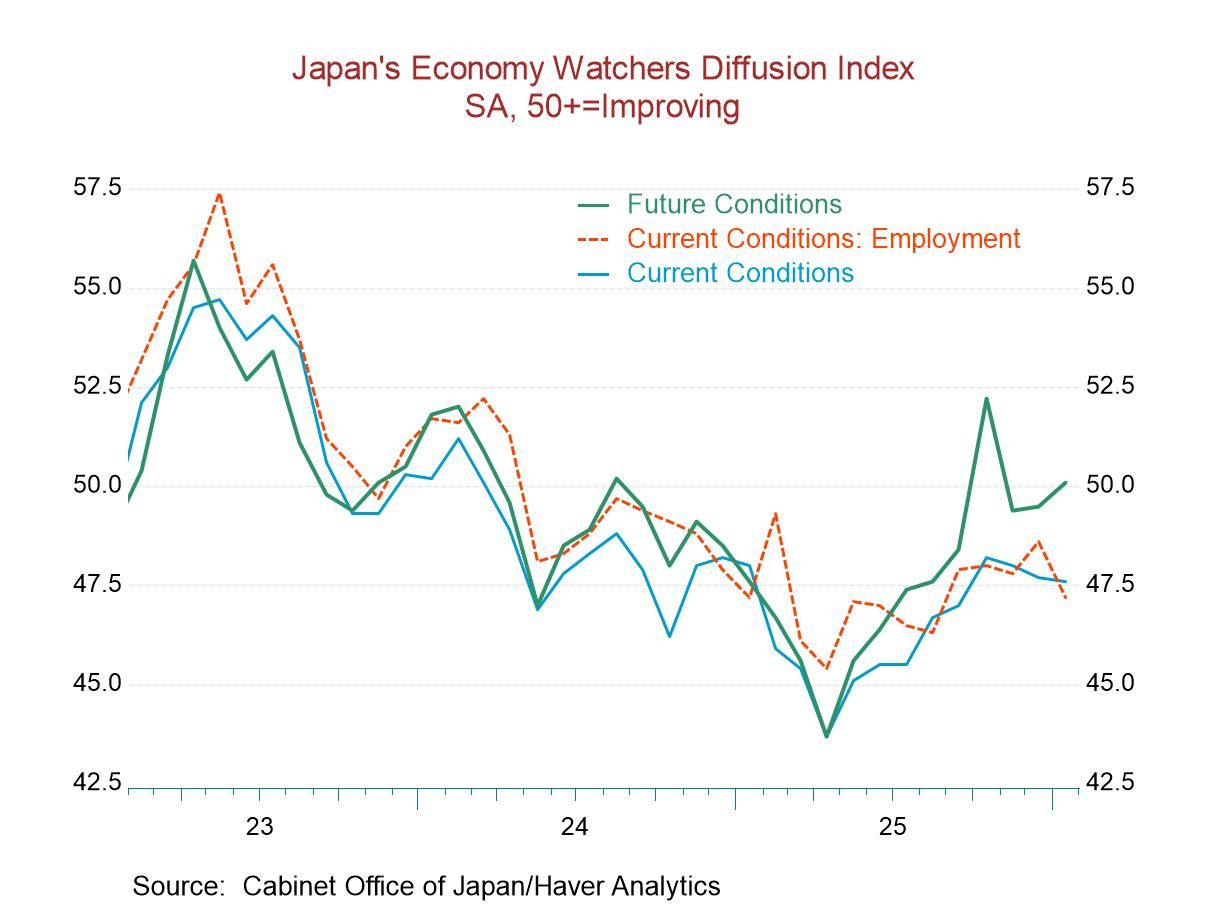

Economy Watchers Indexes Show Firmness; Impact of Takaichi Election to Come in Months Ahead

Japan's economy watchers index has flattened out and backed off slightly for the current and future outlooks depending on the time horizon that you seek. However, what's clear is that the index reached the low point around the middle of last year, has been rebounding and now the rebound has either run out of gas or slowed after the index has rebuilt itself considerably.

It is certainly too early to get pessimistic on Japan's economy, with Prime Minister Sanae Takaichi having just won a significant - essentially a landslide - snap election that she called after recently having been elected. The LDP would appear to be back in the driver's seat, and she has her sights set on more fiscal stimulus and expanded military spending. She is apparently much more on the same wavelength as Donald Trump in the United States. Mr. Trump was an Abe supporter, and Ms. Takaichi is a disciple of Mr. Abe.

At the moment, Japan would seem to have a groundswell of support behind the government and that government is set to try to rekindle some growth which could potentially put the Bank of Japan in a more decisively defensive track as far as setting rates and potentially raising rates.

Economy watchers index is trending In January, the economy watchers index backed off for the second month in a row. However, it still has a percentile standing in its 51-percentile, slightly above its median standing since early-2005. The headline and all the components have standings above their respective 50th percentiles on this timeline, with the exception of housing, services, and employment; three readings that are extremely important to consumers. Housing has a 26.1 percentile standing, services (the employment sector) have a 45.8 percentile standing, while employment has a 22.9 percentile standing. Despite the otherwise solid and strong set of readings, there are these three significant flies in the ointment. Corporate Japan is doing extremely well with corporations having a 66.8 percentile standing; manufacturers and nonmanufacturers, separately, each come in with readings in their mid-to-upper 60th percentiles.

The future index The future readings from the economy watchers index show continued but slight increases over the last few months. Only two future readings weaken month-to-month: housing and employment—once again two key readings as far as consumers are concerned. However, in terms of current monthly diffusion readings, the assessment of households, retailing, housing, and employment all have current diffusion values below 50, indicating net declines rather than increases. The percentile standing is for the future index are, like those for the current index, generally upbeat - and generally stronger than for the current indexes - with the future headline posting a 66.4 percentile standing in January. However, like the current index, the standing for housing is at its 21.3 percentile and the standing for employment is at its 30th percentile, both well below the neutral level that would place the ranking at the 50th percentile. Corporations show high readings, higher for the future indexes than for the current index standings. There also are high readings and standings for eating and drinking places as well as services. It's good to see services come up with a strong rating since it creates hope for the future for employment because services are the core employment sector. It will be interesting to see how this value changes in the coming months as Takaichi’s new policies are implemented and take hold.

Summing up On balance, the economy watchers index has been firm to strong. There is some slight give-back in the current index in terms of trend. But beyond the index, there's more immediate reason to be more positive because Japan has just executed a very decisive and pro-growth snap election that is going to put the new Prime Minister Takaichi and strong control of the economy at a time where she seeks to cement economic strength. These elections were just completed over the weekend, and we will see the results reflected in data in the weeks and months to come.

- Germany| Feb 06 2026

German IP Reveals Chaotic Trends

With the December report, Germany’s production and some of the early European industrial production data reveal a good deal of chaos in terms of the embedded trends. On the month, German industrial production fell by 1.9%, with consumer goods output up by 0.5%, capital goods output falling by 5.3%, and intermediate goods output falling by 1.2%. Among the early reporters in the monetary union—France, Spain, and Portugal—only Spain showed an increase in manufacturing IP in December; however, Spanish industrial production is notoriously volatile.

Broader IP trends in Germany and elsewhere in Europe As for other early industrial production reporters, both Sweden and Norway showed strong-to-solid gains in December and each of them showed two-months of gains in a row. Beyond that, sequential growth rates from 12-months to six-months to three-months show accelerating growth in German consumer goods output against decelerating growth for intermediate goods. Real manufacturing output and real sales show mixed results- no clear trends; however, real manufacturing orders in Germany are off the map strong.

German manufacturing/industrial Surveys German industrial surveys from the IFO for manufacturing shows persistent weakening as well as for IFO manufacturing expectations, and in the EU Commission industrial index in the last three months. More broadly, Germany shows some modest but ongoing step up all of these based on average levels from 12-months to six-months to three-months for IFO expectations and the EU Commission industrial readings with mixed results for other survey readings.

IP trends in Europe For the early reporting EMU members France, Spain, and Portugal, who report industrial production trends, each show mixed monthly trends against ongoing decelerations for manufacturing output over the broader sequential periods (12-month, to 6-month, to 3-month). However, for other Europe, Sweden and Norway, manufacturing trends are steadily accelerating on this broader timeline.

A feeling of ‘Deja- What?’ These combinations of opposed trends mixed with a lack of trends leave us with this sense of confusion about what's going on in manufacturing. For Germany, the extreme strength in orders is reassuring since orders should be forward-looking rather than backward-looking or even contemporaneous. But orders can also be a fickle series and so we'll have to watch it to see if the trends for German orders hold up.

Current quarter-What’s been happening now In addition, current quarter growth for Germany actually looks quite good with industrial production up 3.7% at an annual rate in the current quarter, led by output increases in manufacturing against a decline in the intermediate goods output. Real orders in the quarter are surging at a 44% growth rate, while real sales in manufacturing only had a 0.1% uptick at an annual rate. The industrial indicators for Germany in the quarter show weakness or flatness with the only exception being IFO manufacturing expectations that advanced by a small amount. The three EMU members who report industrial production data show positive growth in the just-completed quarter except for Portugal where industrial production is falling at a 2.9% rate in the fourth quarter. Sweden and Norway, European countries but not monetary union members, show a strong 22% annual rate gain in Sweden against the 3% annual rate decline in Norway.

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

Financial markets have experienced renewed gyrations in recent weeks, as shifting geopolitical risks, questions around Federal Reserve independence, renewed talk of US dollar “debasement,” and ongoing enthusiasm surrounding artificial intelligence have combined to drive volatility across asset classes. These cross-currents have also contributed to a degree of rotation away from high-flying technology stocks, as investors reassess valuations and the timing of anticipated AI-driven gains. Against this backdrop, the charts in this week’s COTW highlight several important themes. Policy rate expectations now appear more balanced globally, marking a clear shift away from the one-sided easing bias of the past two years (chart 1), even as resilient US data—underscored by the unexpected jump in the January ISM index and a run of positive economic surprises—continues to complicate the outlook for monetary easing (chart 2). At the same time, US financial conditions remain relatively benign, with limited evidence of widespread credit stress or aggressive tightening in lending standards (chart 3). Meanwhile, the sharp rebound in semiconductor sales and the accelerating rollout of large-scale AI models underscore why investors remain so focused on the AI narrative, even as Europe lags behind due to weaker industrial momentum and a smaller footprint in advanced chip production (charts 4 and 5). Finally, while some scepticism about AI’s ultimate economic impact persists, the latest survey results suggest a moderation in concerns that markets are materially overestimating its gains (chart 6). Taken together, these developments paint a picture of a US economy that remains more resilient than many had anticipated, set against a financial landscape increasingly shaped by powerful—if sometimes competing—narratives around geopolitics, policy, and technological transformation.

by:Andrew Cates

|in:Economy in Brief

- USA| Feb 05 2026

U.S. JOLTS: Openings Drop to Lowest Level Since Sept. ’20; Hiring Rebounds in December

- Job openings down 5.6% (-12.9% y/y) to 6.542 mil., third straight m/m decline.

- Hiring up 3.4% (-1.5% y/y) to 5.293 mil., first m/m increase since September.

- Separations rise to a three-month high; quits reach a six-month high; layoffs rebound.

- USA| Feb 05 2026

U.S. Initial Unemployment Claims Surged in Latest Week

- New claims jumped 22,000 to 231,000, the highest level since December 6.

- Continuing claims rose to 1.844 million from 1.819 million.

by:Sandy Batten

|in:Economy in Brief

- of2700Go to 7 page