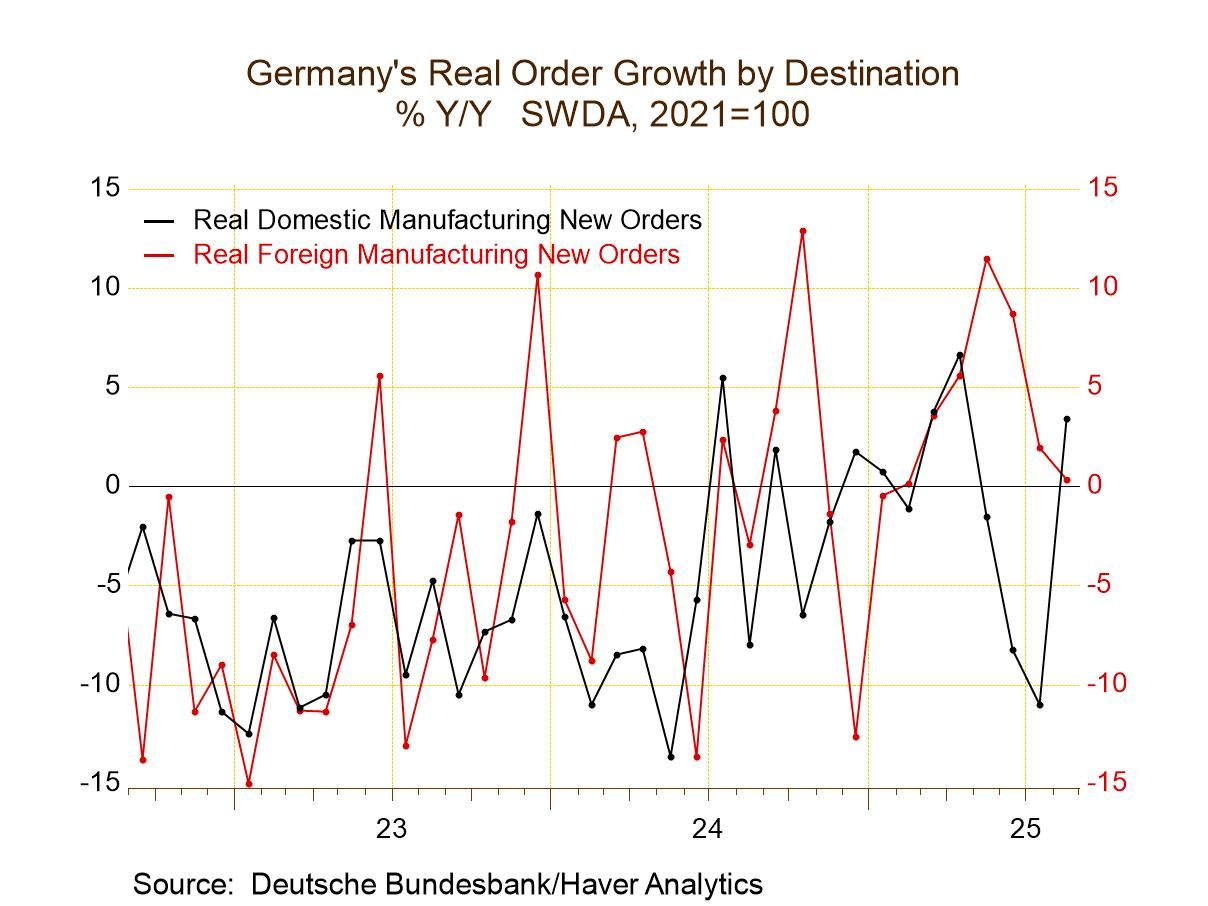

German orders fell by 0.8% in August, dropping for four months in a row. Foreign orders have been and continue to be chronically weak. Domestic orders that made a strong rebound in the month have been erratic in recent months although they seem to be on a recovery path.

Total German factory orders are sequentially weakening on growth of 1.6% over 12 months, 0.5% annualized over six months and logging an annual rate of decline of 14.2% over three months. This path is largely driven by foreign orders that are weakening progressively and sharply. Foreign orders rise by just 0.4% over 12 months, then fall at a 1.6% annualized pace over six months and collapse at an annualized rate of -31.2% over three months. In contrast, domestic orders engage a moderate accelerating path that is topped off by extremely strong growth. Domestic orders rise by 3.4% over 12 months and at a slightly stronger 3.7% pace over six months and accelerate to 20.8% annualized over three months.

Quarter-to-date overall and foreign orders are declining with domestic orders following suit. Foreign orders show substantial contraction in the quarter while domestic orders contract at a much less violent pace.

Rankings as an order-vetting process If we further vet orders by their levels, a weak judgement-standard over such a span even for ‘real’ orders, rankings on levels since 1990 show foreign orders at the 70% mark and domestic orders at a quite weak 35-percentile. However, rankings based on year-over-year growth rates drop the foreign order ranking to 38.5%, below their median and raise domestic orders to their 61.9 percentile. Total orders ranked by growth have a 49.2 percentile standing, nearly a median ranking; while total orders ranked on levels have a 58.4 percentile standing.

Real sales Real sales for manufactured goods, viewed sequentially, show mixed trends with manufacturing overall having no clear tendency other than that of slight contraction. Consumer durable goods orders show accelerating contraction. Other categories are without clear trend. Quarter-to-date most categories show contraction in the quarter. Levels of real sales rankings show an above-median 50.7% for all of manufacturing boosted by capital goods with a 69.7 percentile standing and supported by intermediate goods with a slight under median 47.1 percentile standing. Consumer goods sales standings are extremely weak. But sales based on growth rates (12-months) show rankings below 50% for all sales categories – most are at the one-third mark.

EMU industrial confidence in large countries Industrial confidence metrics for the four largest EMU member economies show broad weakening in August except for France; but all of the countries had improved industrial confidence in July. Sequentially the patterns are mixed for these four countries. Compared to year ago, values for two of them improved (France and Spain) while two other deteriorated (Germany and Italy). The queue standing on levels which are a fairer comparison on diffusion data (like this) show all readings below their 50-percentile mark (the median), with Germany at an anemic 12.9 percentile rank, the weakest of all and Spain at a 46.8 percentile ranking, the strongest.

On balance, this is a disappointing report for Germany. Its domestic economy seems to be on the right track, but its key customer base in foreign markets appears to be struggling more. It’s a mixed view, at best.

Global

Global