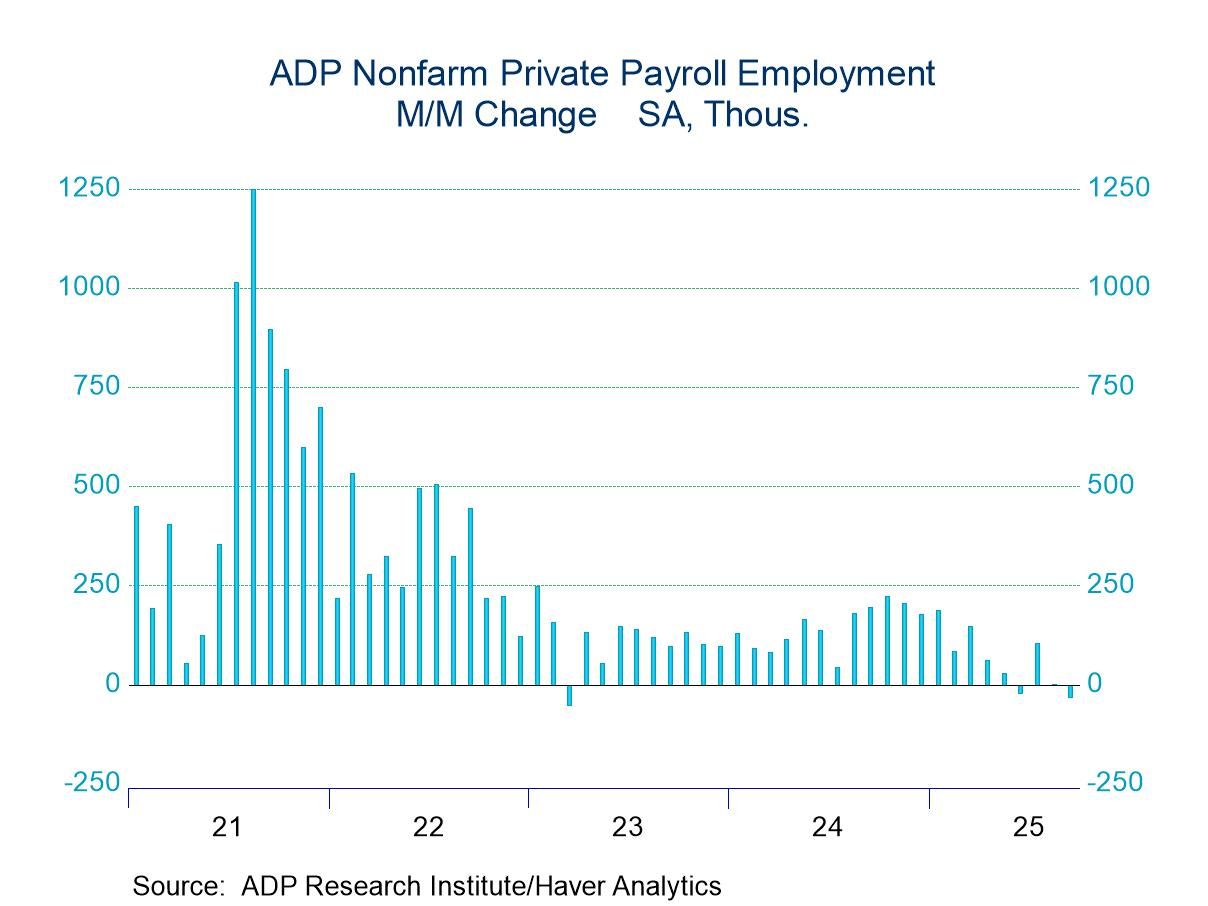

- Drop in private payroll jobs is third in last four months.

- Service-sector jobs decline sharply; construction & factory hiring weakens.

- Job-changer wage growth moderates.

- USA| Oct 01 2025

U.S. ADP Employment Declines Unexpectedly in September

by:Tom Moeller

|in:Economy in Brief

- USA| Oct 01 2025

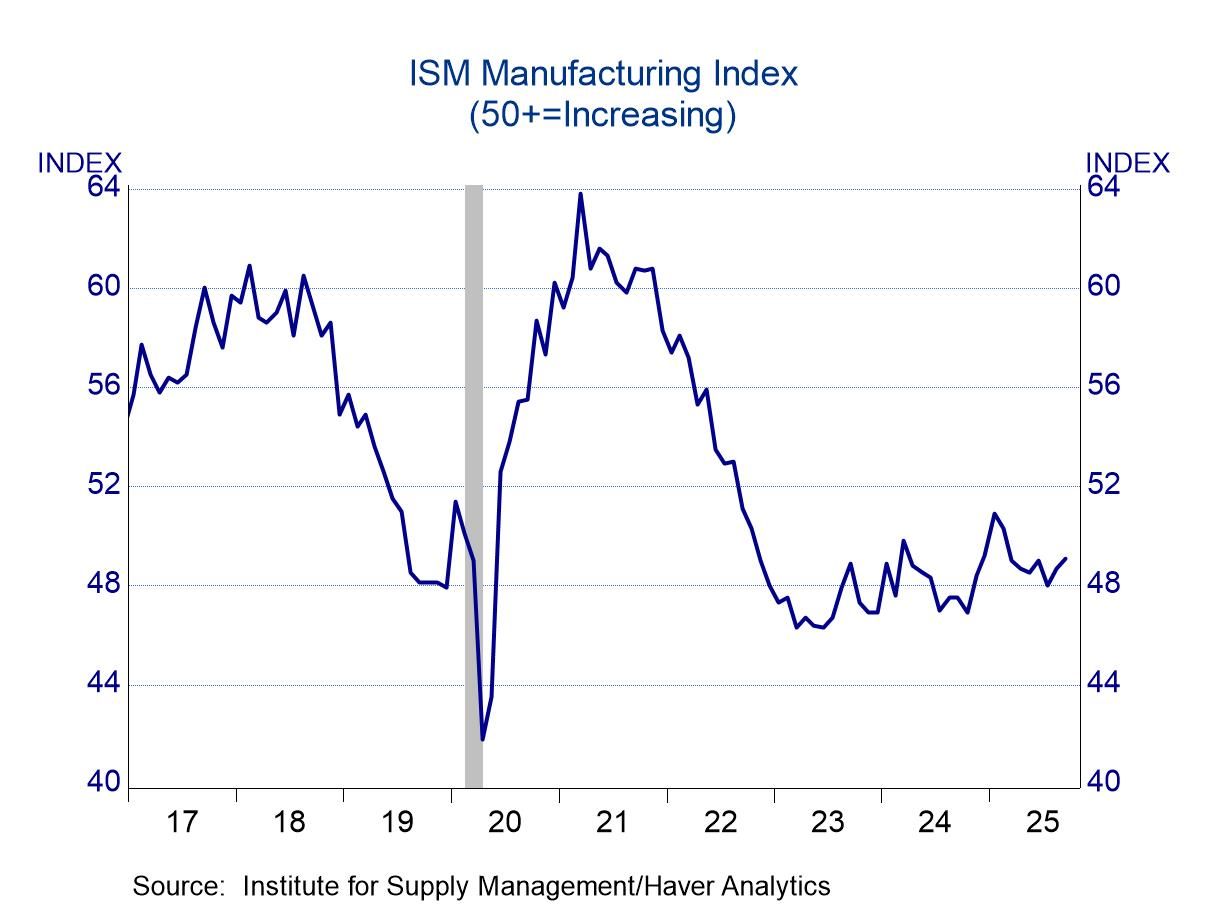

ISM Index: The Manufacturing Sector Continues to Struggle

- The production and employment components registered gains.

- But new orders disappointed.

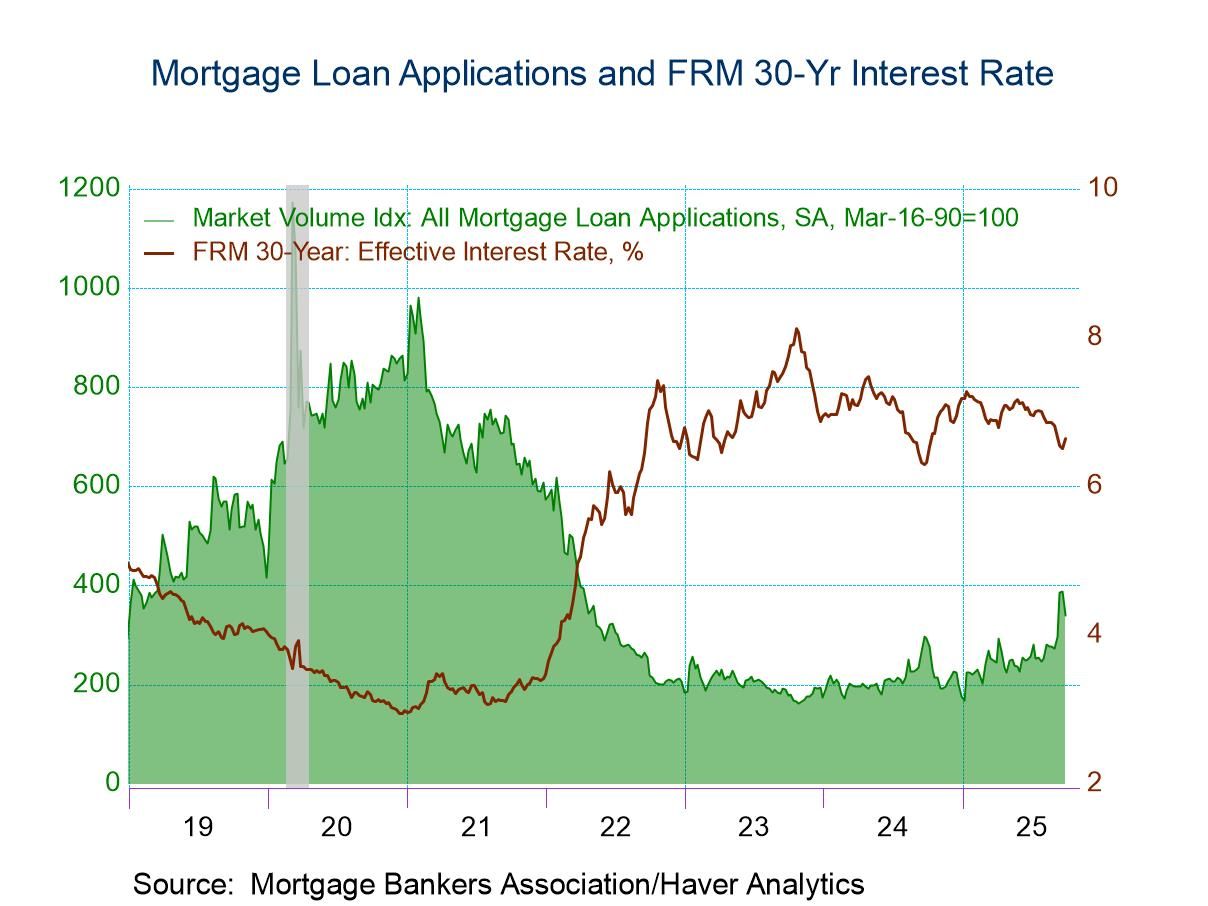

- Purchase loan applications dropped 1.0% w/w, and refinancing loan applications plummeted 20.6% w/w.

- Effective interest rate on 30-year fixed-rate loans rose 13 bps.

- Average loan size declined.

Global| Oct 01 2025

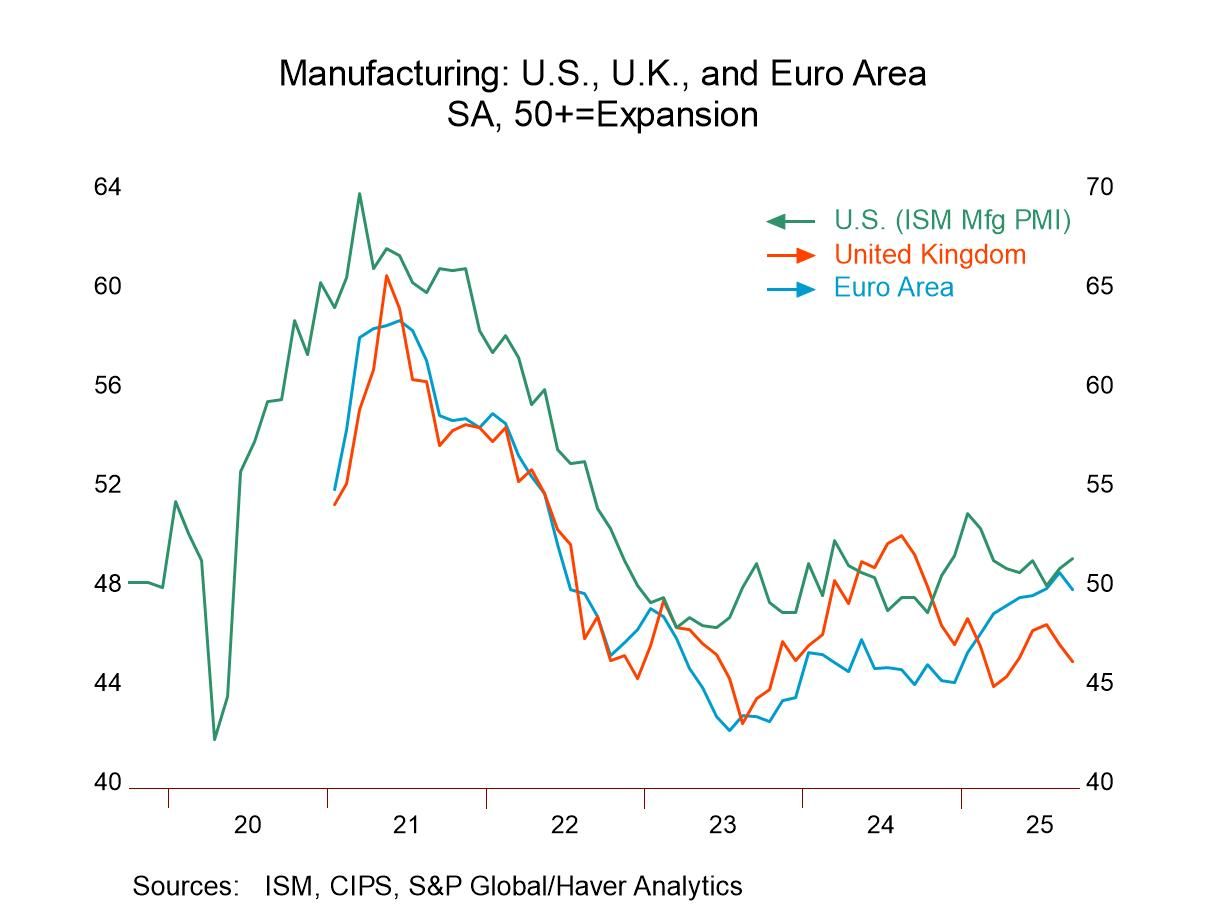

Global| Oct 01 2025Global MFG PMIs Mostly Erode in September but by Small Amounts; It’s Really a Nothing-Burger of Economic Change

Manufacturing PMIs in September worsened for all the countries in the sample except for China and South Korea. The diffusion calculation was 11% in September but that compares to 83% in August and 55% in July; in past months improvement was much more common. Comparing the sequential results of 12-months to 6-months to 3-months, the median over 12 months is 49.2, over 6 months it's 48.8, and over 3 months it's 49.3. These are not compelling numbers in any direction and they show that output in manufacturing is simply hovering in a very slightly contractive position to 12-months ago.

The diffusion calculations that compare 3-months to 6-months, 6-months to 12-months across countries are steady at 66.7%. All those horizons regularly show improvement for two-thirds of the reporting countries over each of those horizons.

The queue rankings, however, indicate there's still a great deal of weakness with ten of the reporting countries having PMI readings since January 2021 that are below their respective medians. Output is above the respective medians for eight countries.

The bottom of the table presents statistics grouped in different ways a grouping of developed countries, the BRICs, other Asia. On that basis, there's really not much discrimination except that the BRIC countries show average readings that for the most part are above 50; other comparisons for the most part are below 50. The statistics, though, clustered around 50. The global medians call PMI values below 50 while the global averages coalesce at readings slightly above 50. And while these are differences, there's not much distinction between these differences.

In addition, we know that the queue rankings show a great deal of weakness in the current percentile standings which also leaves us with the conclusion that manufacturing is not particularly robust.

There are five countries or areas showing sequential improvement from 12-month to six-month to three-month averages and there are five of them showing sequential weakening on the same time horizon. In both cases, the transitions are small.

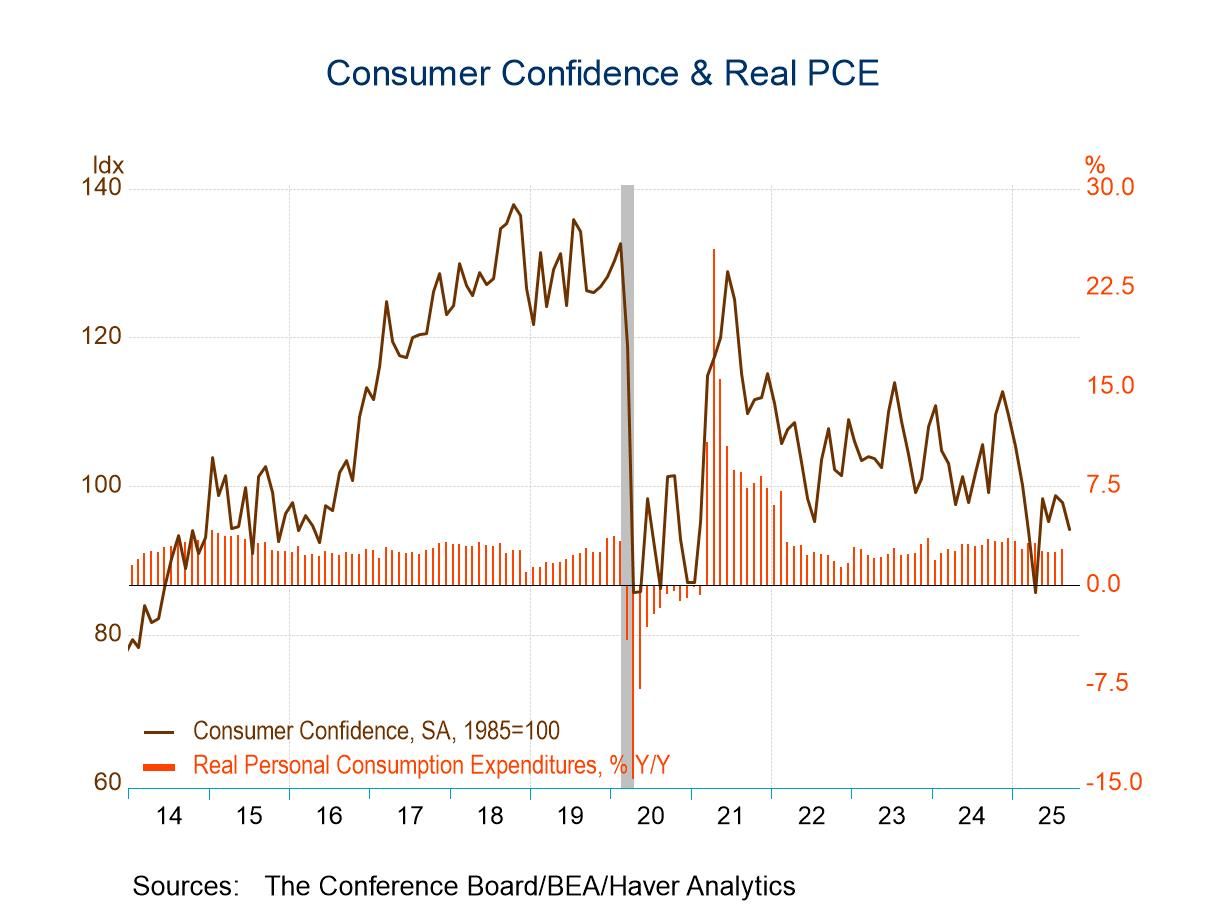

- Confidence level is lowest since April.

- Present situation & expectation readings decline.

- Inflation expectations reverse August increase.

by:Tom Moeller

|in:Economy in Brief

- USA| Sep 30 2025

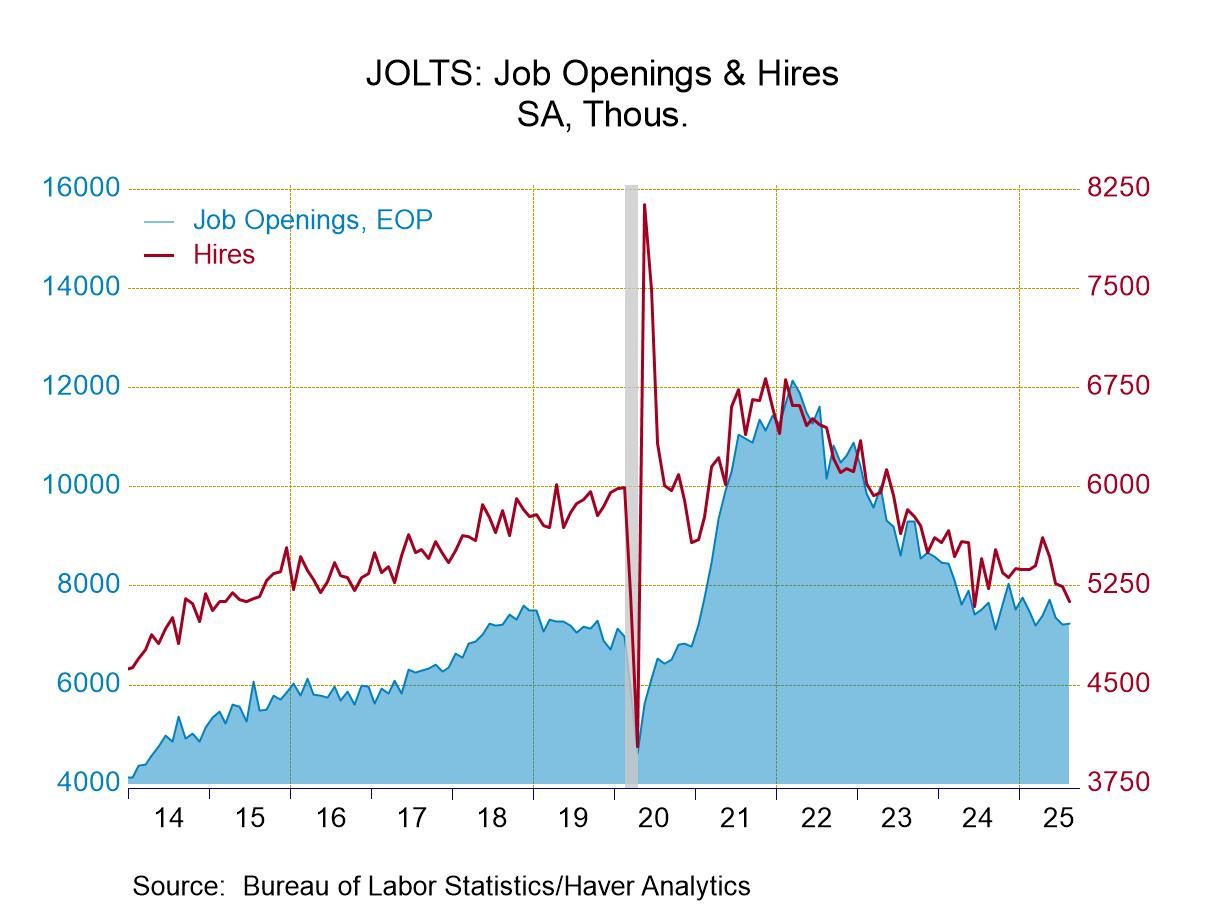

U.S. JOLTS—Openings Edged Up, Hiring and Layoffs Fell in August

- Job openings edged up 0.3% m/m in August after declining in both June and July.

- Openings were less than the number of unemployed for the second consecutive month.

- Hiring declined 2.2% m/m in August, the fourth consecutive monthly decline.

- Total separations fell 2.1% m/m, reflecting declines in both quits and layoffs.

by:Sandy Batten

|in:Economy in Brief

- USA| Sep 30 2025

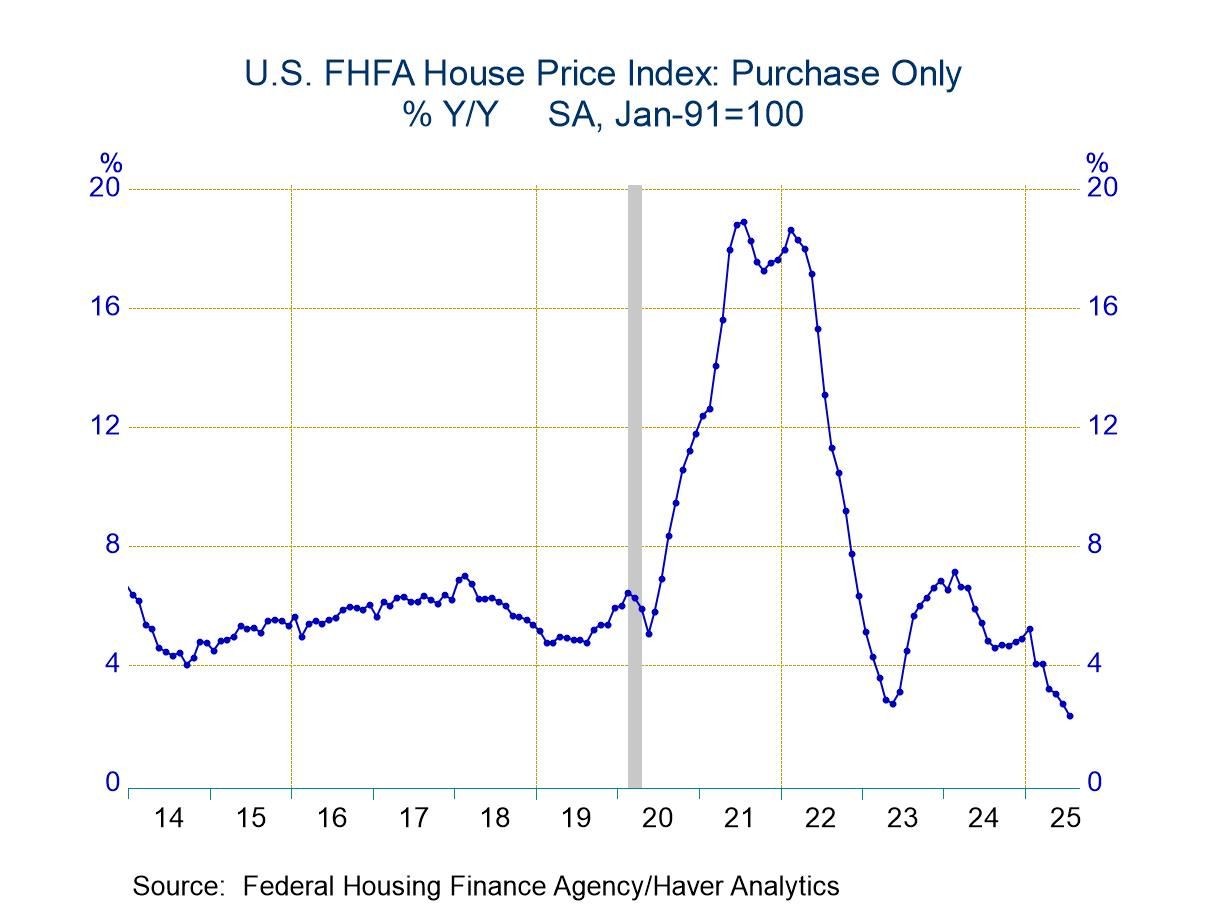

U.S. FHFA House Prices Ease in July

- Prices edge lower for fourth straight month.

- Year-to-year increase is lowest since 2012.

- Monthly price changes are uneven amongst regions.

by:Tom Moeller

|in:Economy in Brief

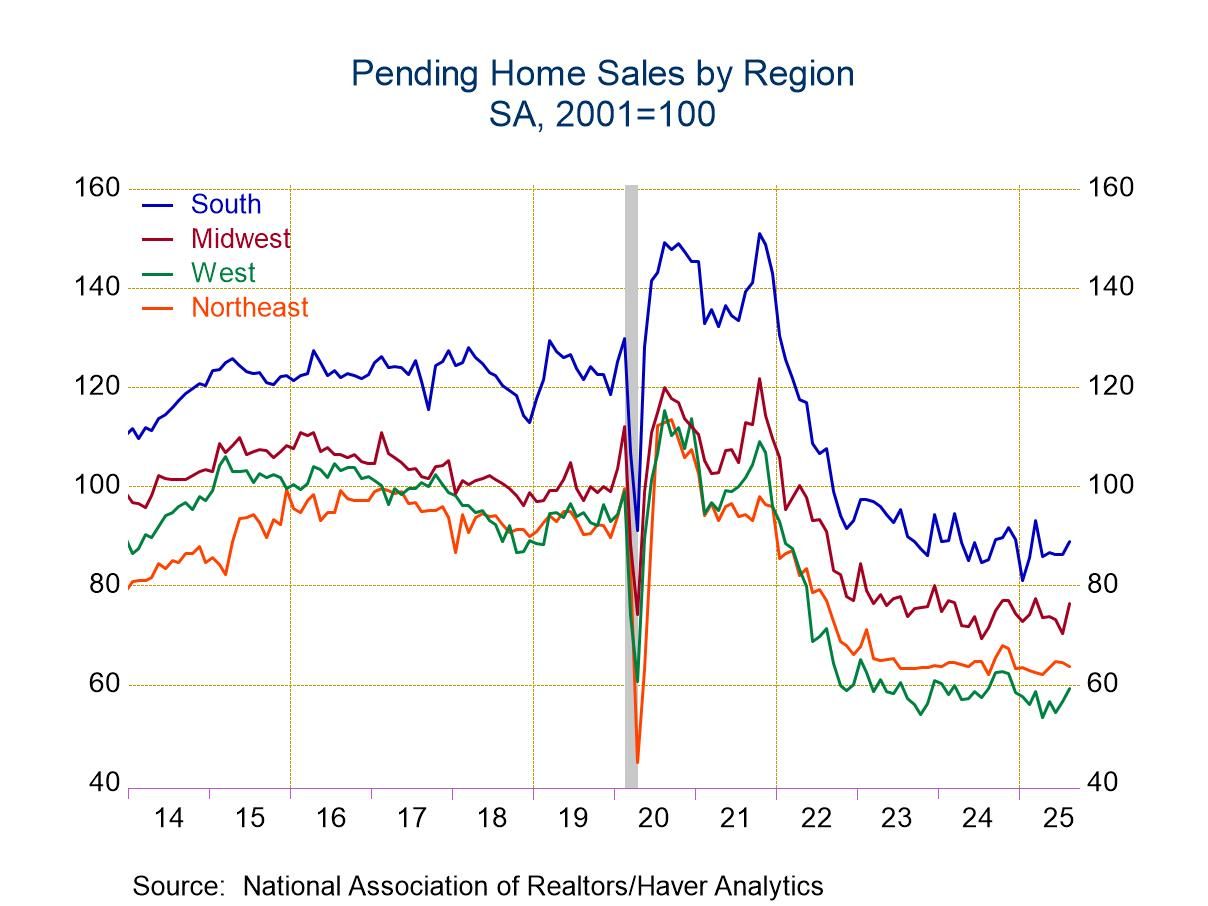

- Sales rise to highest level since March.

- Increase follows declines in three of prior four months.

- Regional changes are mixed.

by:Tom Moeller

|in:Economy in Brief

- of2693Go to 29 page