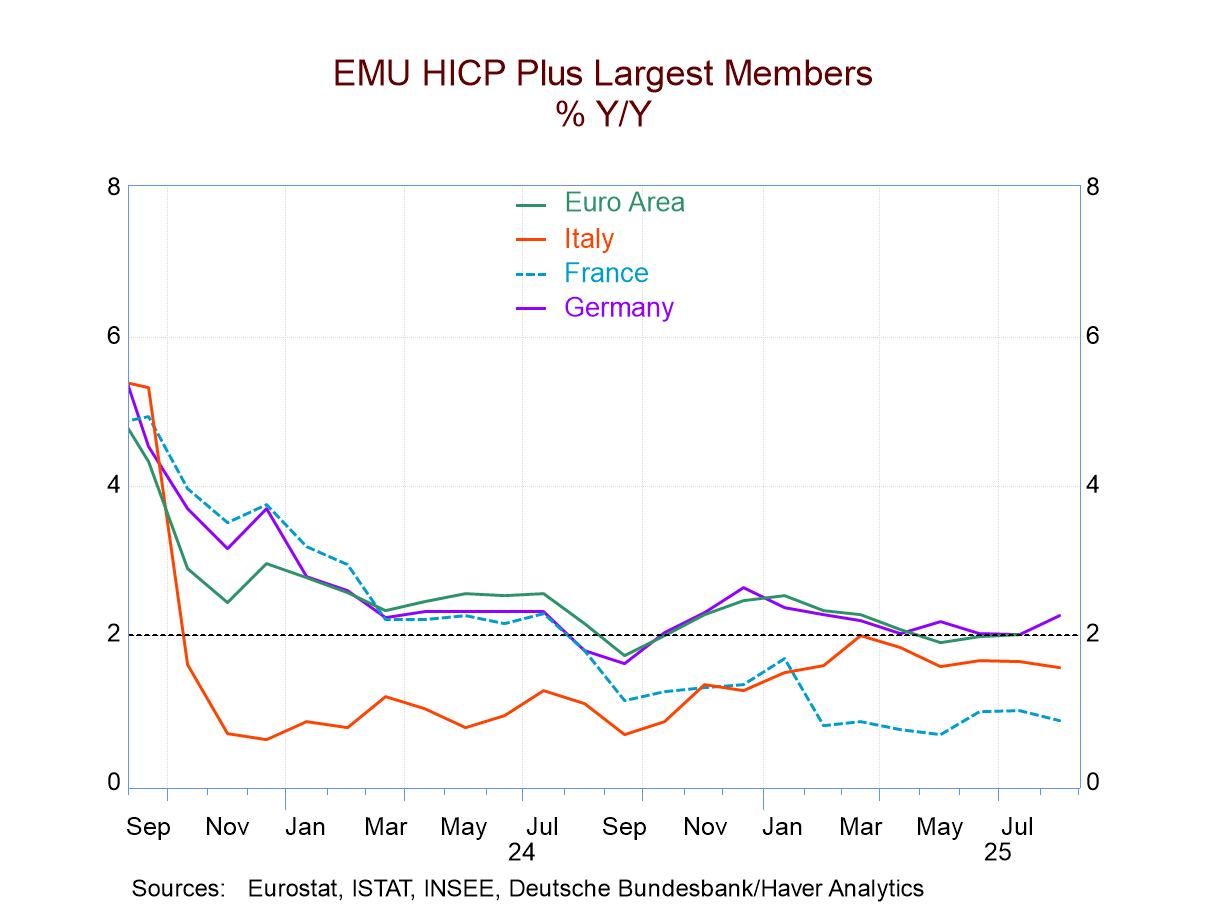

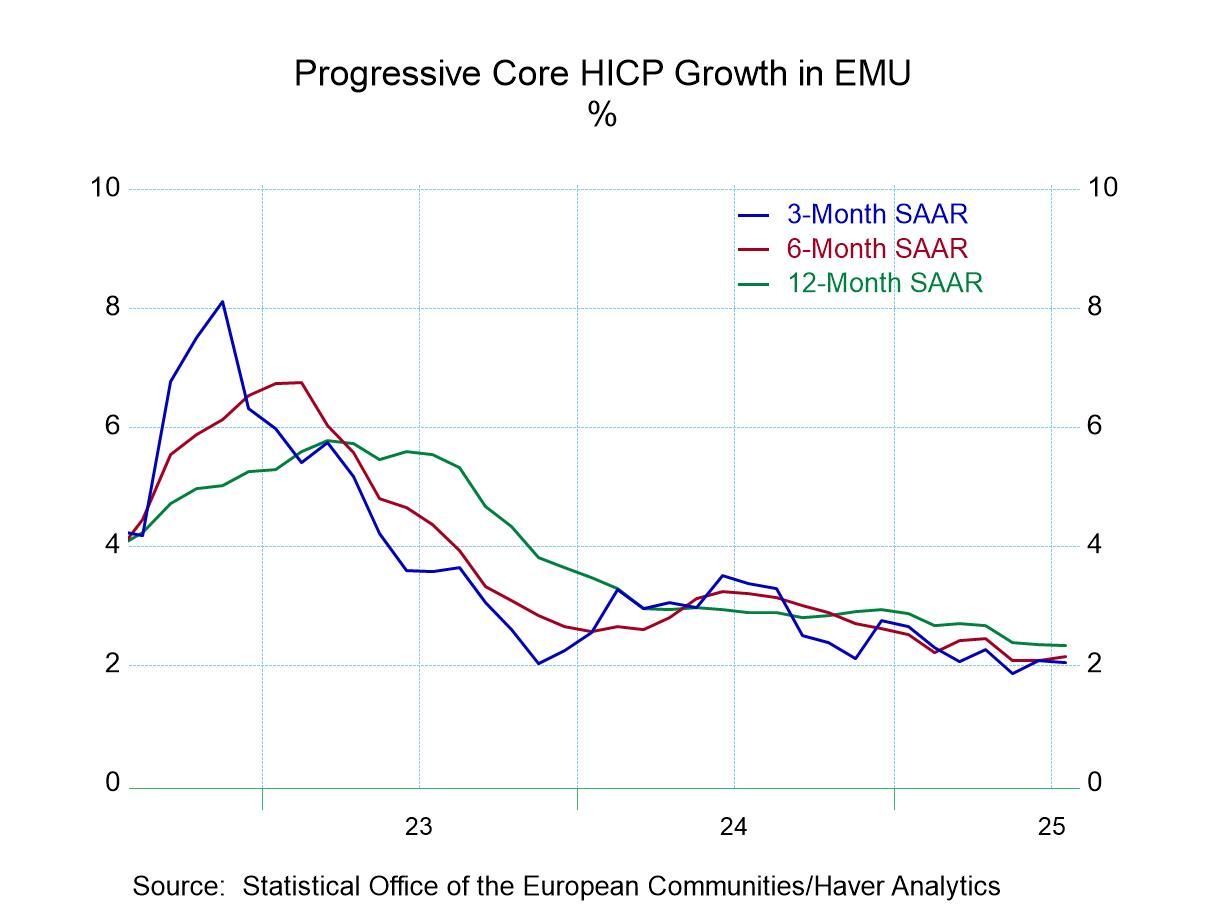

Inflation in August was well behaved; the headline series with the monetary union posted a gain of 0.2% after 0.3% gains in each of the previous months. Still those increases mean that the three-month inflation rate is at 3% compared to 2.1% over 12 months. Stop headline inflation has grown moderately hot in the monetary union.

Across countries the largest EMU members has so well-behaved inflation in August, with Germany up 0.2%, France up 0.1%, and Italy and Spain both unchanged. However, inflation in the previous two months was a bit stronger leaving three-month inflation rates for France, Italy, and Spain over 2%. Over six months only Italy is over 2% and that's barely, and over 12 months only Spain is substantially above the 2% mark.

Core inflation in the monetary union is where the elusiveness and stubbornness is for the three large economies that report core inflation. Germany actually reports ex-energy inflation. Italy and Spain report core inflation. They're all showing increases of 0.3 and 0.2 over the last two months. Over three months German ex-energy inflation is running at a 2.4% annual rate with Italy's core at 2.7% and Spain's core at 3.8%. Over 12 months German ex-energy inflation is up at a 2.6% annual rate, compared to a 2.4% annual rate for Spain’s core and Italy’s core that that is nearly on the money at a 2.1% annual rate.

The 12-monht inflation rate is marginally worse for headline and core rates across this group of countries in August compared to July. For the EMU, the headline is the same at 2.1%. Even though shorter measures show some pressure building, 12-month inflation is marginally lower in August 2025 than in August 2024 for headline and core measures in the large countries.

However, there has been no sense of controlled inflation recently as all averages are clearly excessive with the average five-year reading at a low of 3% for core inflation in Italy to a five-year average high of 4.5% in Germany. This legacy for inflation is still a problem for some although central bankers around the world are trying to dismiss it as a past event; however, no one's quite sure whether inflation is really over the hump and going back to normal for good.

Global

Global