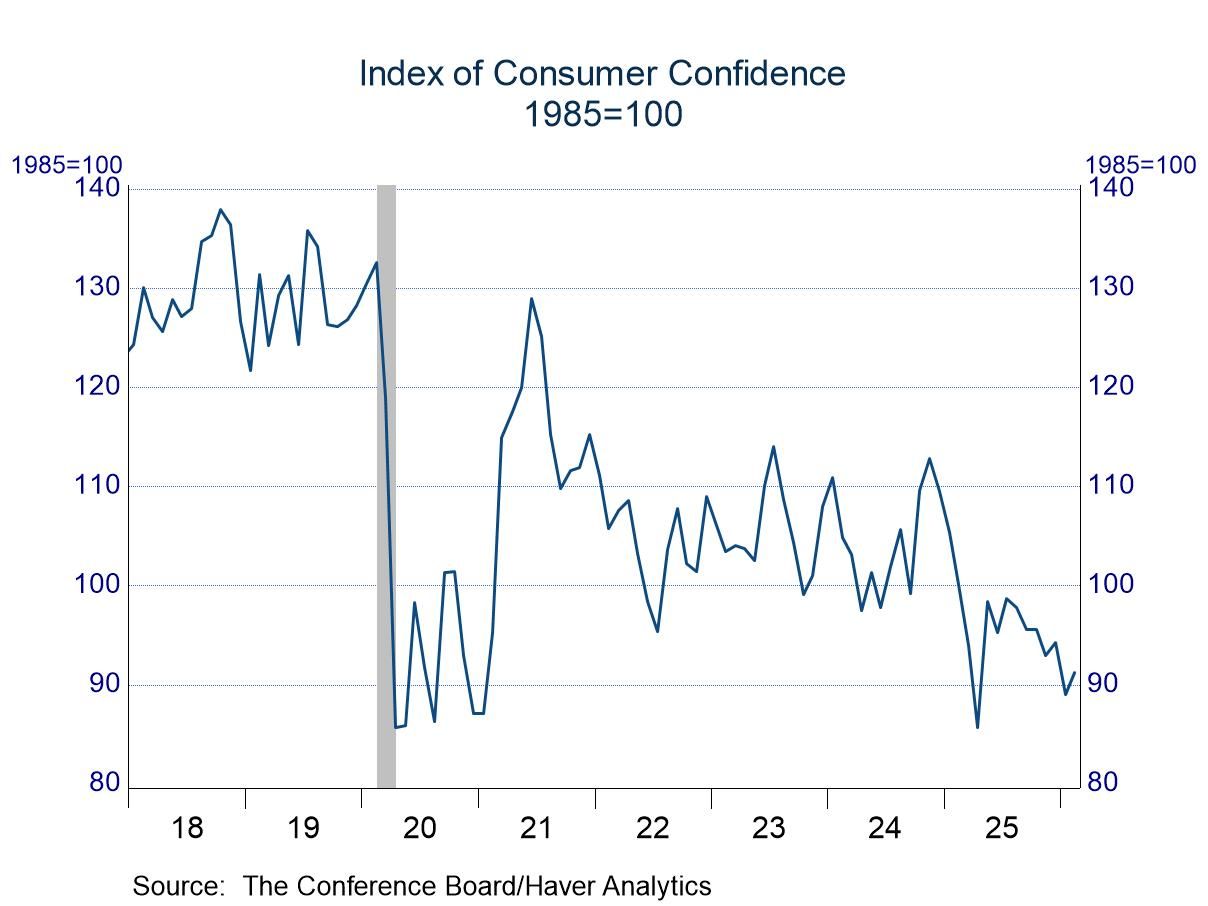

- Firmer expectations offset dimmer views on the present situation.

- Although views on the present situation dipped, assessments of the labor market picked up.

- USA| Feb 24 2026

Consumer Confidence: Improvement in February from Upward Revised Levels in January, but Individuals Are Still Unhappy

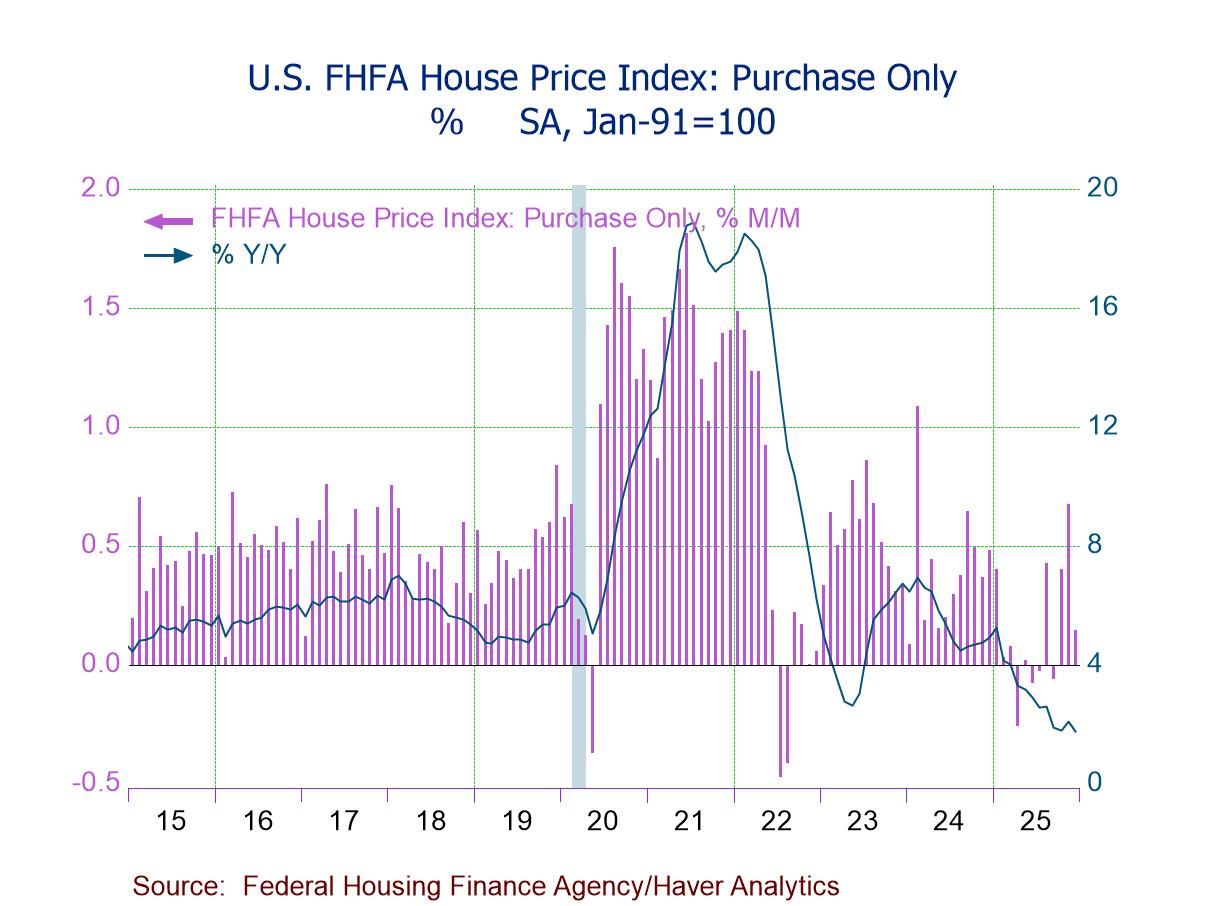

- FHFA HPI +0.1% (+1.8% y/y) in Dec., the smallest of three straight m/m gains.

- House prices up m/m in six of nine census divisions, led by Middle Atlantic (+1.1%), but down in West South Central (-1.0%) and East South Central (-0.1%); prices flat m/m in Pacific.

- House prices up y/y in six of nine regions, led by East North Central (+5.2%), but down in Mountain (-0.6%), Pacific (-0.4%), and South Atlantic (-0.1%).

- House price growth accelerates to 0.8% q/q (+1.8% y/y) in Q4'25 from 0.3% q/q (+2.4% y/y) in Q3.

- France| Feb 24 2026

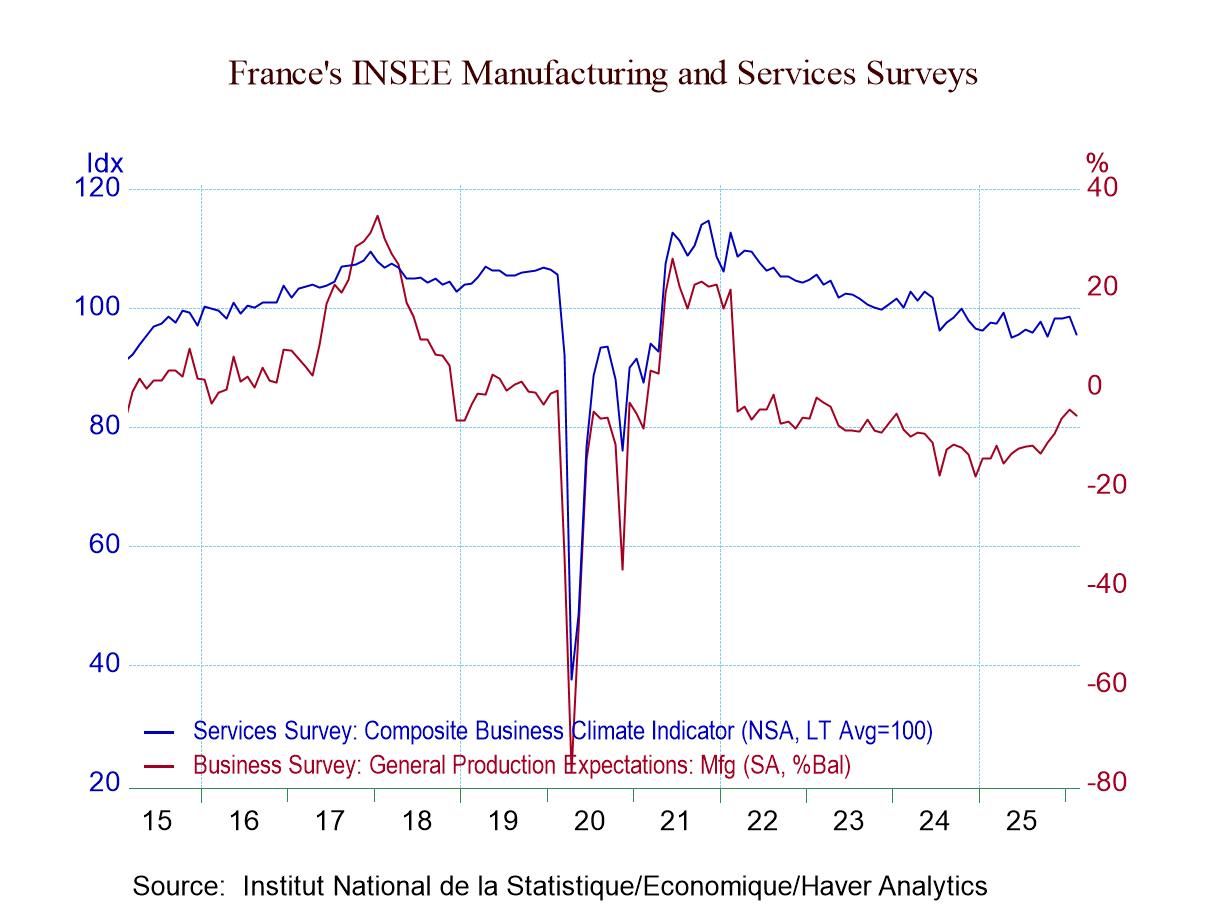

French Manufacturing and Services Surveys: Two Sectors, Two Different Trends, and Lingering Weakness

Neither the service sector nor the manufacturing survey value is particularly strong. The services climate headline has a 25-percentile standing; it has been higher about 75% of the time. That is not a good result. For manufacturing and industry, the standing is just short of the 50% mark which leaves it quite close to its historic median. That is not strong, but it is not weak either; it’s a modest middle ground. But February’s reading gave up ground, falling to 102.1 from 105.4 in January, back essentially to its December 2025 level. Even so, the February value has not been exceeded persistently until we go back to August 2022—three and one-half years ago.

The rebound in manufacturing is nascent; we can question its sustainability. And it is also only a modest step up after February’s erosion. Orders and demand flared higher in January and backed down in February. Orders and demand have a 50-percentile standing, with foreign orders much stronger at a 75-percentile standing. While production has a sub-median, 42-percentile standing, responses, when aggregated, show an ‘own-personal’ response standing at 62.2%. Maybe there is more granular, industry-level confidence that is being restrained by macroeconomic pessimism. This two-tier response is recreated compatibly for prices where firms see high own price trends stronger than their whole-economy trend. The own-price trends are elevated with a ranking over their 60th percentile while the macro price expectation is at a 48-percentiel standing. Production expectations are a classical representation of this month’s survey, falling back this month after some improvement last month and sporting a 49.1 percentile standing – a near median result. The manufacturing survey does not suggest any trouble; it exhibits near normal behavior, with orders at a midstream level/ranking.

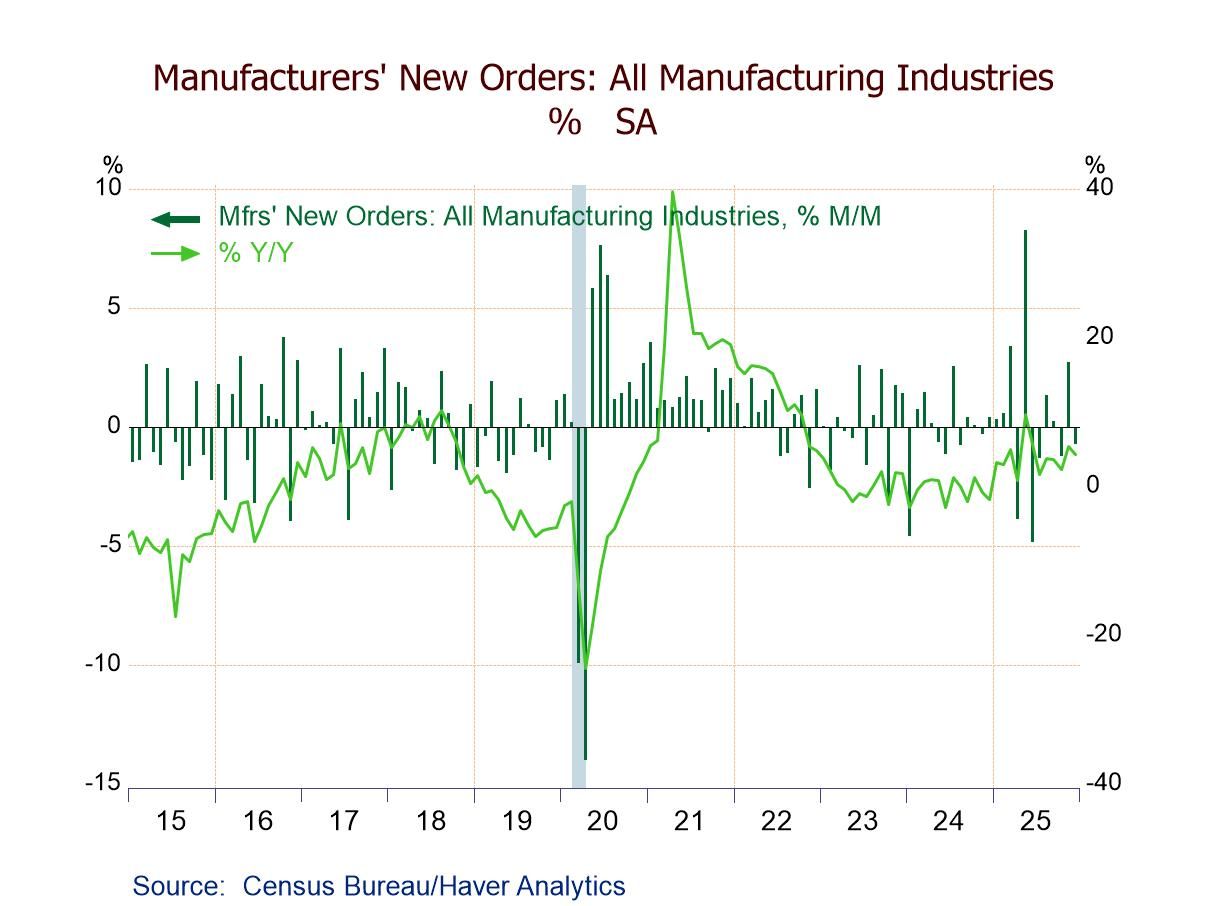

- December factory orders -0.7% m/m (+4.3% y/y); still 7.2% above the Jan. ’24 low.

- Durable goods -1.4% m/m; nondurable goods orders flat; shipments +0.5% m/m.

- Transportation orders -5.4% m/m, led by a 24.8% plunge in nondefense aircraft orders.

- Unfilled orders +0.9%, the fifth straight m/m rise.

- Inventories +0.1%, the second consecutive m/m increase.

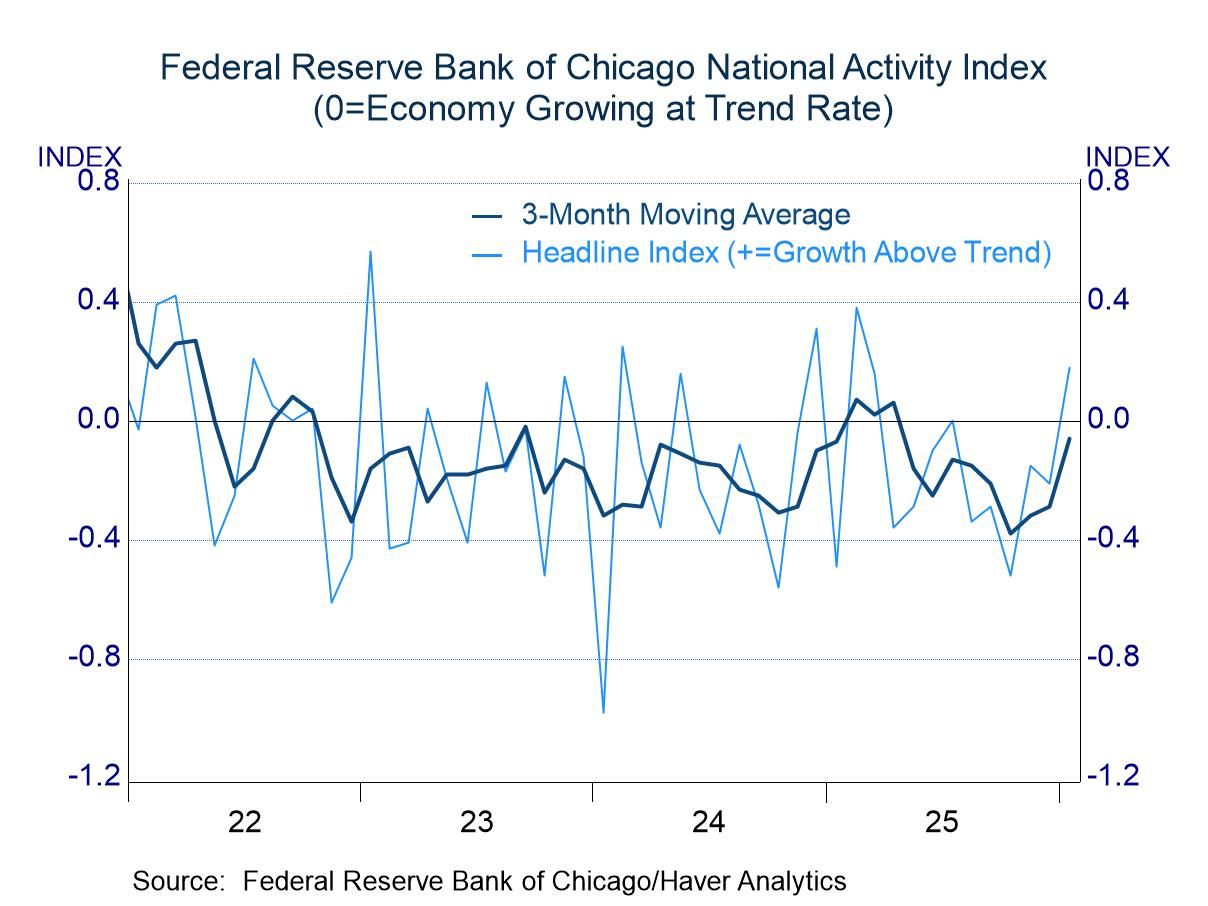

- January results showed noticeable improvement from prior months.

- All four components contribute positively.

- Germany| Feb 23 2026

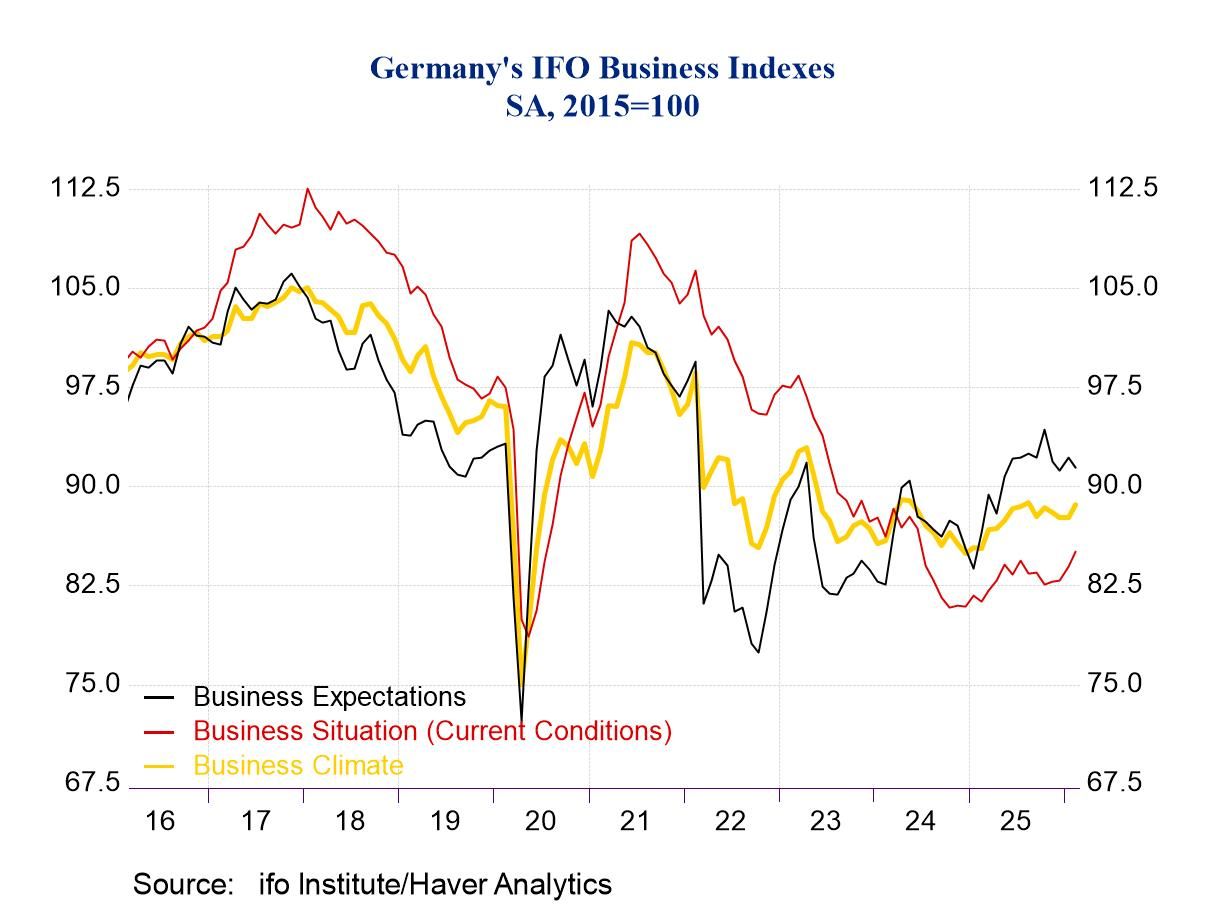

German IFO: Business Confidence Claws Its Way Out of a Hole

Germany's IFO index shows improvement in February compared to January. The climate index improves, the current conditions index improves, and expectations improve. All three all-sector headlines improve in February compared to January. However, all three metrics continue to register net negative readings, indicating that the sectors are showing more contraction than expansion, but less contraction than it had been the case previously. We ranked these headlines on data back to 1993; the climate index has a 22.5 percentile standing, expectations have a 22.4 standing, and current conditions have a 16.9 percentile standing. All three of the headline metrics have standings in the lower quartile of their queue of values back to the early 1990s. This is clearly not a stellar report but a report from an economy that is struggling. Even though it's widely reported that the climate index is currently on a six-month high; it may be on a six-month high, but it's not really much different than it was six months ago and only up by 1.1% from its lowest mark in the intervening five months—so not impressive. This is a grueling, crawling, dig-out from difficult circumstances. The COVID pandemic was a sucker punch to the global economy, and it was followed by the Russian invasion of Ukraine that hit Europe especially hard because of the proximity.

Since then, other geopolitical tensions have risen. Europe's relationship with the United States has deteriorated, in part because Europe—Germany in particular—was reluctant to detach itself from its mercantile relationships with Russia and was also reluctant to increase its financial participation in NATO. The U.S. was carrying the burden of the protective umbrella for Europe at a time when Europe didn't really think it needed a protective umbrella and so it was unwilling to pay for anything more substantial. When the rainy day came and when the Russian invasion of Ukraine occurred, Europe was completely unprepared and the U.S. was its protector. While Germany and other European countries quickly made it clear that they were fully on board with NATO defense, the U.S. was much less enthusiastic about carrying the burden after Europe had put its financial probity ahead of its defense spending obligations. Now Europe does not see the U.S. and its perceived greater needs for security because of improved navigation from the Arctic Circle to the North Atlantic.

These troubles continue to dog the relationship between the United States and Europe, and the European Community. And Europe’s own economic struggles continue. In the climate readings, all four of five sectors improve from January to February. Current conditions improve in three of the five sectors, with retailing and wholesaling slipping month-to-month. Expectations do improve overall, but three of five sectors take a step back in February, with expectations improving sharply for services, and substantively for wholesaling. Still manufacturing, construction, and retailing expectations stepped back.

Across the three broad areas of assessment across five sectors in each, there are only two (two of fifteen) sector metrics that rank above their 50th percentile (above their respective medians) when ranked against readings back to 1993. Both of those elevated rankings are for construction, one for Climate, and the other for current conditions, but construction expectations, at a 44.5 percentile standing, are not far below their median.

Still, the lowest environmental standings are for services, except under expectations where the services reading is second-weakest to retailing. The graphic shows some tendency for an upturn in climate and current conditions, but they are countered by an expectations path that has topped out and has been gradually leaning lower—and doing that with a current ranking in only its 22.5 percentile. So, while there is some life in the IFO survey this month, we are still looking at a patient in intensive care, not one ready to join Olympic competition—at least not yet.

Asia| Feb 23 2026

Asia| Feb 23 2026Economic Letter from Asia: Asia and AI

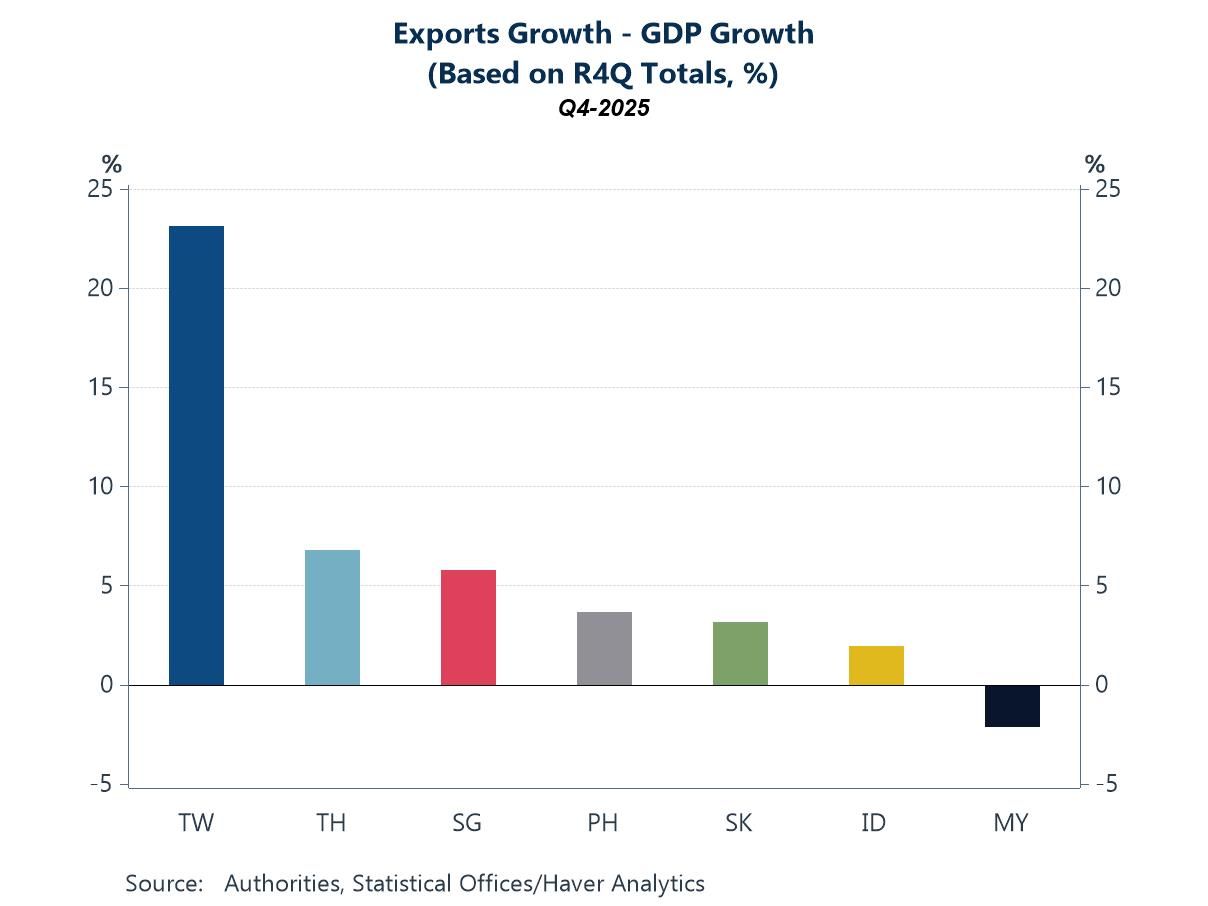

In our Letter this week, we delve deeper into AI, with a focus on Asia and, where relevant, comparisons with the US. The global economy remains firmly in the buildout phase of AI, where much of the near-term economic benefit is derived from investment in hardware and enabling infrastructure—such as AI chips, memory, and data centres. At the same time, though still at a relatively early stage, firms are beginning to adopt advanced AI capabilities and integrate them into workflows in pursuit of productivity gains. So far, labour productivity improvements have been evident in parts of Asia (chart 1), largely driven by stronger exports (chart 2) and capital deepening—similar to trends observed in the US (chart 3) and, within Asia, in economies such as Malaysia (chart 4). However, these gains have yet to translate into a clear and sustained acceleration in total factor productivity (TFP), which accounts for the combined use of labour, capital, and other inputs—though TFP is admittedly a challenging metric to estimate, as illustrated by the US case (chart 5). This raises an important question: what happens when the AI buildout phase begins to moderate, and the associated investment-led tailwinds fade? At that point, further AI-related gains will depend more heavily on the successful embedding and diffusion of AI across sectors. On this front, Asian economies remain at very different stages of readiness to adopt AI (chart 6), suggesting that the next phase of productivity gains may be uneven across the region.

The productivity story Several Asian economies have already recorded substantial productivity gains in recent years, even before the narrative around AI-driven productivity boosts gained traction last year. As shown in chart 1, measured by labour productivity—simply defined as output per employed person—economies such as Taiwan and several in Southeast Asia stand out for their strong performance. However, these gains cannot be attributed solely to the promise of AI. By definition, labour productivity rises whenever output (the numerator) grows faster than employment (the denominator). Such an outcome can stem from a range of factors—cyclical recoveries, capital deepening, sectoral shifts, or efficiency improvements—and does not necessarily reflect widespread AI adoption.

- USA| Feb 20 2026

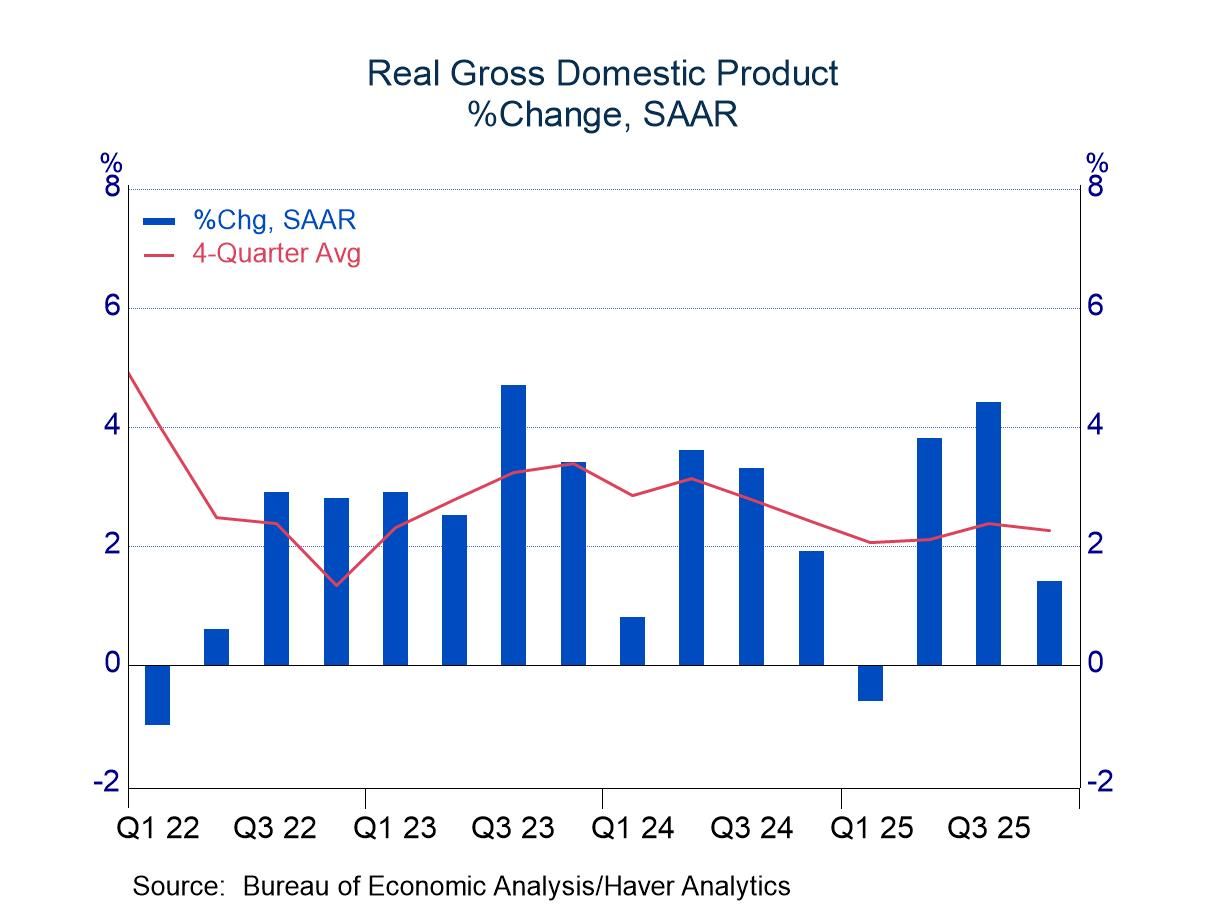

Q4 GDP: Constrained by Federal Spending

- Non-federal activity was lighter than expected, but still respectable.

- PCE inflation remains stubborn.

- of2700Go to 3 page