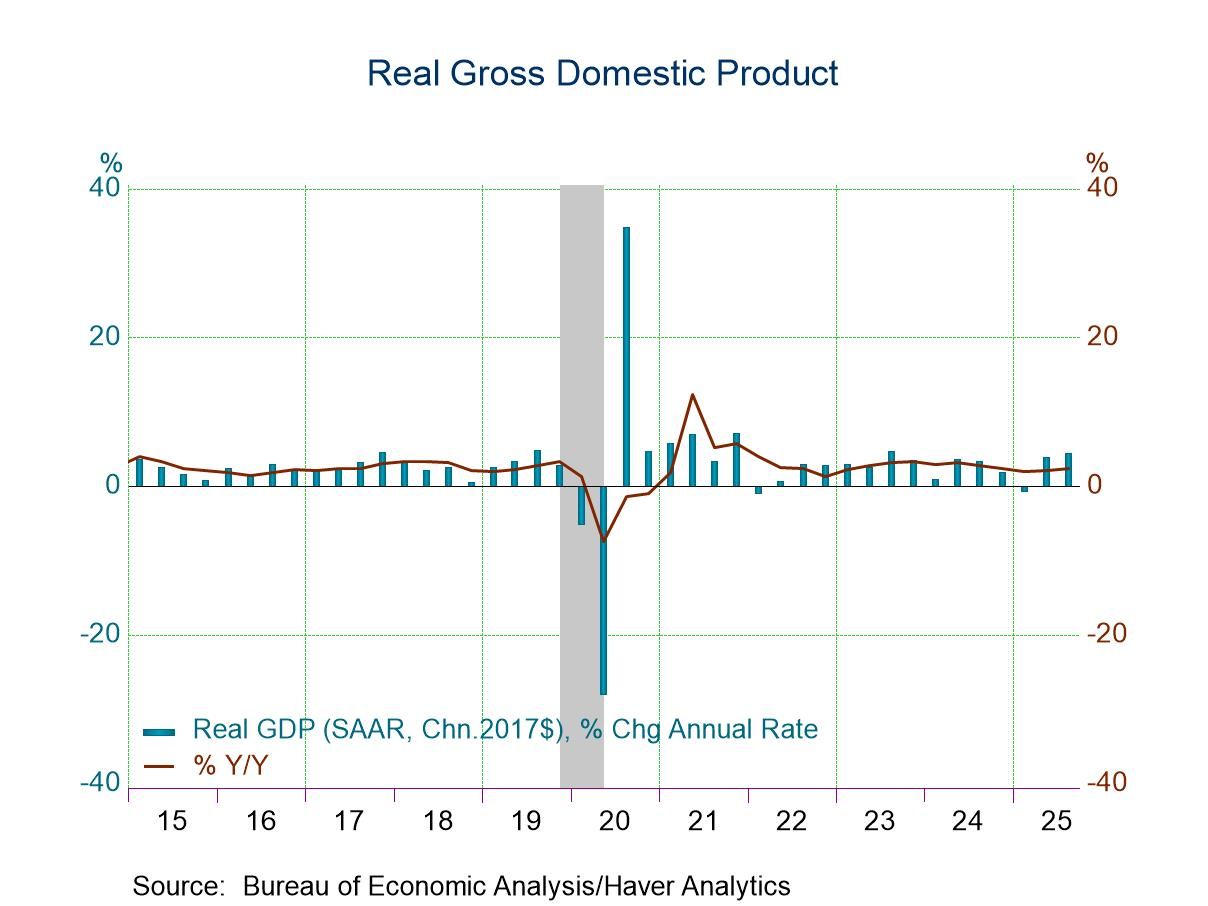

- Real GDP grew 4.4% q/q saar in Q3 2025, up slightly from 4.3% previously reported.

- The modest upward revision was due mostly to slightly stronger nonresidential fixed investment, a larger increase in exports and a smaller decrease in inventories.

- Growth of domestic demand remained solid in Q3 but was revised down 0.1%-point.

- GDP and PCE inflation were unrevised at 3.8% and 2.8%, respectively. Both are meaningful accelerations from Q2.

- USA| Jan 22 2026

U.S. Q3 GDP Growth Revised Slightly Faster

by:Sandy Batten

|in:Economy in Brief

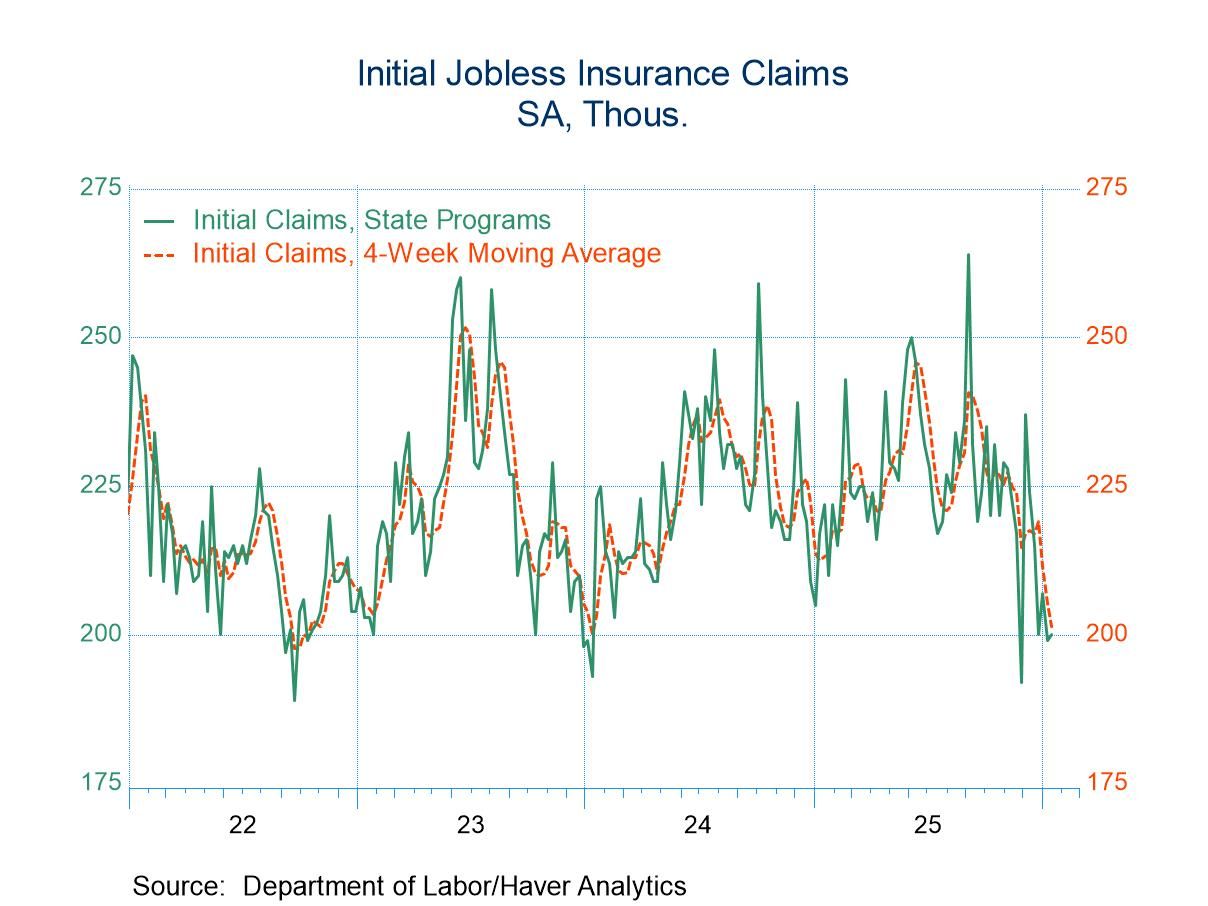

Initial claims for unemployment insurance edged up 1,000 to 200,000 in the week ending January 17, from 199,000 in the week ending January 10, revised from 198,000. The four-week moving average of initial claims was 201,500 in the January 17 week, down 3,750 from 205,250 in the January 10 week, revised from 205,000, and reaching the lowest level for this average since January 13, 2024, when it was 200,000.

Federal government employees initially filed 1010 (NSA) jobless insurance claims in the week ended January 10, after filing 646 (NSA) claims in the week ended January 3.

The total number of unemployment insurance beneficiaries – also known as “continuing claims” –decreased by 26,000 to 1.849 million in the week ended January 10 from 1.875 million in the week ending January 3, revised from 1.884 million. The four-week moving average was 1.871 million in the latest week, down from 1.887 million in the January 3 week, revised from 1.889 million. The insured unemployment rate remained at 1.2% in the week of January 10, unchanged from previous 6 weeks.

Federal government employees’ continuing benefits claims were 12,977 (NSA) in the week ending January 3, from 12,803 (NSA) in the week of December 27.

The insured unemployment rate varied greatly across individual states and territories. In the week ending January 3, the highest unemployment rates were in Rhode Island (3.27%), New Jersey (3.17%), Washington (2.85%), Minnesota (2.75%), Massachusetts (2.74%), Oregon (2.37%), Connecticut (2.31%), Montana (2.26%), California (2.21%), and Alaska (2.06%). The lowest rates were in Florida (0.29%), North Carolina (0.40%), and Louisiana (0.43%). Rates in other notable states include New York (2.28%), Pennsylvania (2.23%), Illinois (2.21%), and Texas (1.14%). These state data are not seasonally adjusted.

Data on weekly unemployment claims are from the Department of Labor itself, not the Bureau of Labor Statistics. They begin in 1967 and are contained in Haver’s WEEKLY database and summarized monthly in USECON. Data for individual states are in REGIONW back to December 1986.

- Belgium| Jan 22 2026

Belgian Consumer Confidence Up and Strong; Fear of Unemployment at 35-Year Low! Is That Possible?

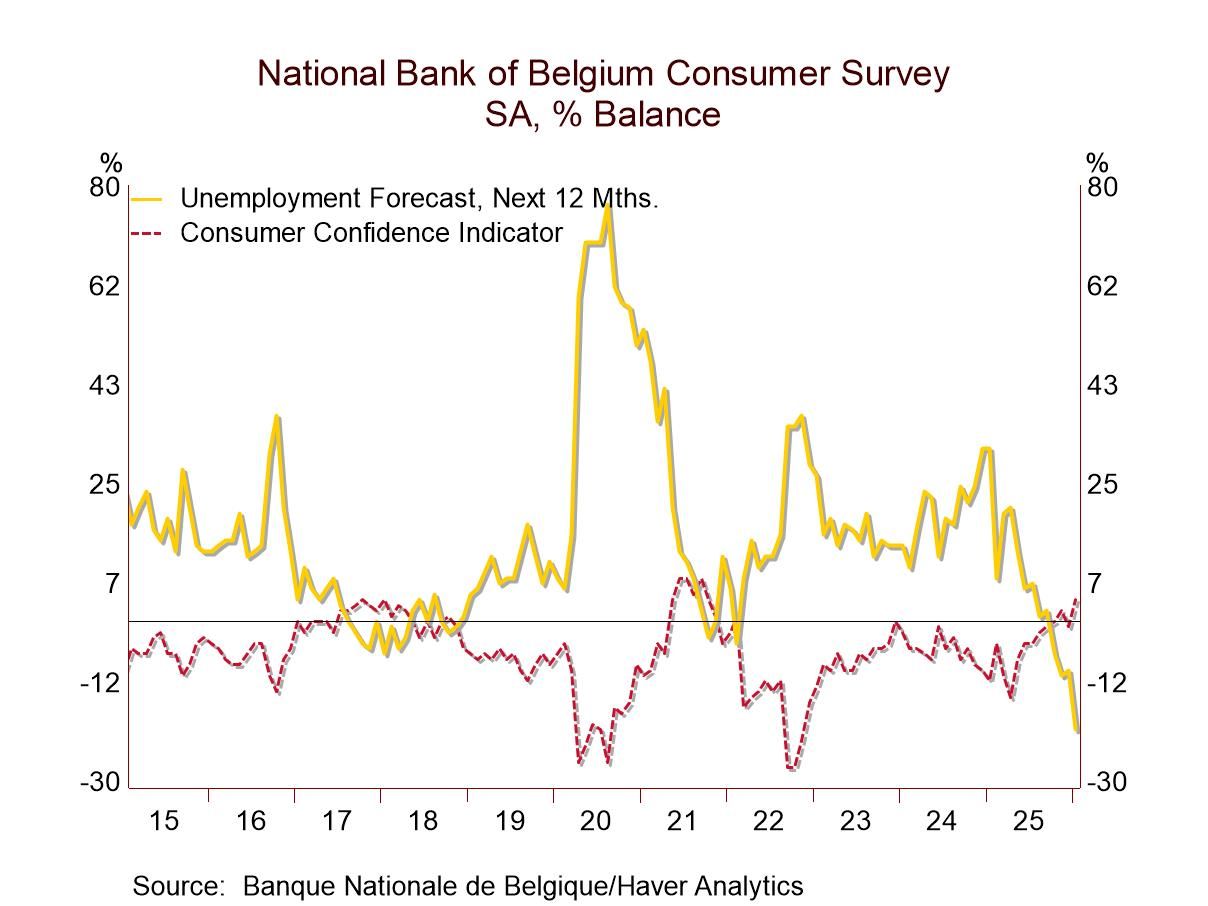

The National Bank of Belgium index for January 2026 rose to +4 from -1 in December, stronger than its November 2025 reading of +2. The survey value is exceptionally strong, lying in the top 6% of all observations back to 1991, even as the survey contains significant variations that range from strong to quite weak across its various components. What is most notable is that the index itself is extremely high-ranking; the current situation appraisal is also quite high-ranking; and, that the forecast for unemployment embedded in this survey is at a 35-year low. Considering current circumstances, against the events of the last 35 years, that's a rather remarkable finding especially considering the world situation.

The times, they are a changin’ was Dylan 50 years early? These have been remarkable times in a number of different ways with a clear transition from the circumstances of the post-war period under way. The solidarity of the NATO alliance is clearly in a situation in flux, revealed since Russia invaded Ukraine. Prior to that, the Europeans had resisted putting more money into the NATO pot as the United States had been frantically asking them while it funded most of the security umbrella. Now, in the wake of these new events, and with the changes to the global stage wrought by climate shifting, the U.S. finds Greenland to be a more important piece on the geopolitical chess board and wants to have more say there in order to protect its own flank as Arctic ice packs recede. This is after a period when NATO basically failed to engage in the front-line protections of its own doorstep that the U.S. had thought were necessary. Not surprisingly, the U.S. found that whole episode unsatisfactory and is now reluctant to give up control to NATO of what it regards as the protection of its own back door for the area around Greenland. But at last, Europe and the U.S. appear to have a deal or the makings of one, so, stay tuned. Maybe all civility is not lost.

Geopolitical shifts meld with economic issues to change the landscape Geopolitical shifts are part of the problem because geopolitics and economics help shape one another. And there has been a great deal of economic turmoil as well. The U.S., after reassessing the Post War order, is bringing back to life tariffs, in order to try to get economic leverage after running 33 consecutive years of current account deficits under what people want to call a free trade system. The U.S. finds itself with a still very overvalued dollar and in a situation where its current account deficits are poised to continue to run high and perhaps get higher. Economists say tariffs are not the solution, but maybe they ARE the wake-up call that will lead to a solution? Europeans have also shifted to embracing a larger and larger government sector and ever larger fiscal deficits and more fiscal debt while absorbing migrants. This is constraining its ability to have any kind of a flexible macroeconomic policy and is a severe problem already for the U.K. and France. And these changes are wreaking havoc with what has been a very solid post-war Atlantic alliance.

Views change But the changes that the U.S. has pushed on to the system from its geopolitical adventurism to its use of tariffs and other strong rhetorical comments have led economists to focus on the elevation of uncertainty in the economic system. Elevating uncertainty has an adverse impact on the economy and on growth. I mentioned this with the obvious caveat that this warning by economists seems to have been completely wrong. U.S. growth has turned out to be quite resilient and even strong. It is not the only adamant position that has proved to be wrong and malleable. Despite the reality of climate change, the view that once took carbon as the main and unequivocal climate change agent, itself is shifting. Opposition to carbon has dwindled, more as the U.S. is embracing nuclear power. Artificial intelligence is becoming a strong bet for stronger growth in the future, and this explains why there have been so many shifting views on energy since artificial intelligence requires massive amounts of energy and would make it impossible to make progress on carbon and to push ahead with the AI agenda at the same time. So, instead of delaying AI, the view on carbon had to go. So much for ‘science.’

Why are Belgians so satisfied? The finding that in Belgium consumer confidence has risen sharply in this environment and fears of unemployment are the lowest they've been in 35 years is another shocking development in this pantheon of incredible and shocking changes. As the above discussion points out, a lot is changing and NATO is at odds with the U.S., its lynchpin. Yet, there is no clear increase in uncertainty in Belgium, while they maybe more in Brussels.

The Belgian Survey: strong despite waffles Belgians do not read the economic situation over the next 12 months as that strong at a reading of -29 on the survey; it has weakened over the last few months, and the economic situation assessment is only at its 8.3 percentile, an extremely weak standing. Price trends are the opposite; they have eased somewhat in the recent months, but over the next 12 months the assessment still has a top 14-percentile evaluation. It is in this context that the unemployment forecast, which is the lowest in 35 years, emerges as surprising. The environment to make major household purchases over the next 12 months is only a mid-range at a 45.7 percentile standing. And people rate their financial situation over the next 12 months slightly better than at the end of last year but at only a 34.2 percentile standing. However, the appraisal of the current situation moved up sharply in January and has a 97.7 percentile standing, which is extremely strong.

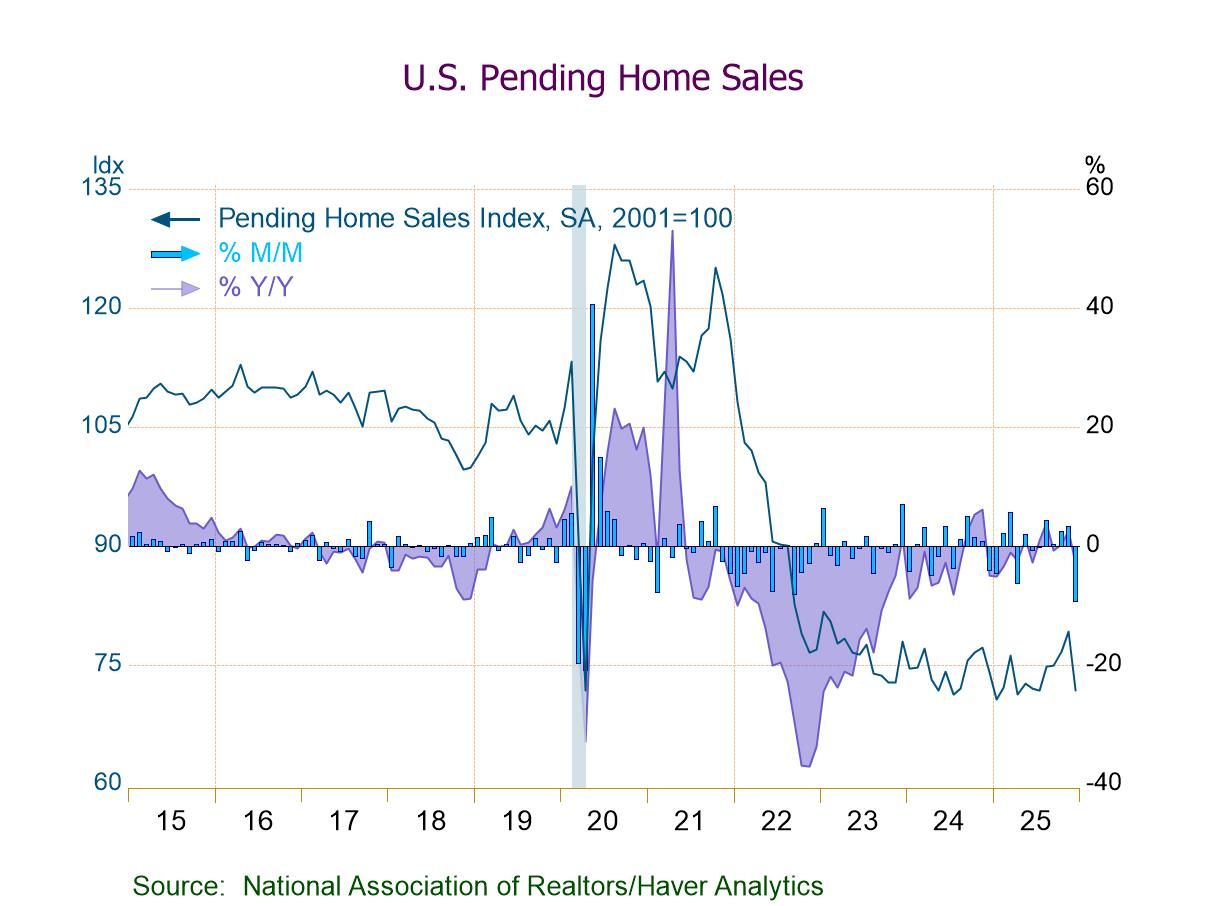

- PHSI -9.3% m/m (-3.0% y/y) to 71.8 in Dec., lowest index level since July.

- Home sales m/m down in all four major regions, w/ the Midwest seeing the steepest drop (-14.9%).

- Home sales y/y down in the Northeast, Midwest, and West, but up in the South (+2.0%).

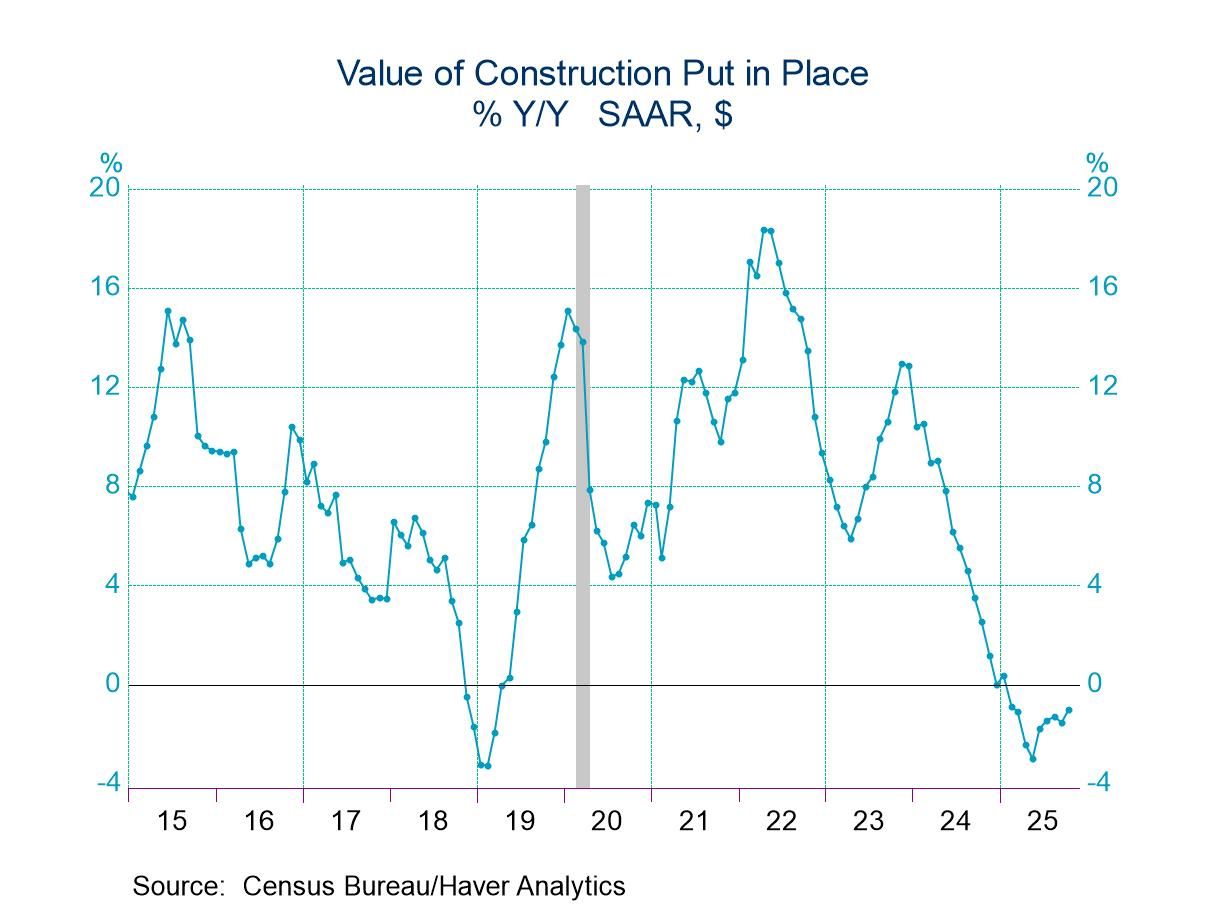

- Total construction spending fell 0.6% m/m in September but rebounded 0.5% m/m in October.

- Private construction spending slumped 0.9% m/m in September but rose 0.6% m/m in October.

- Private nonresidential construction fell for the fourth consecutive month while private residential construction posted a 1.3% m/m gain.

by:Sandy Batten

|in:Economy in Brief

- Purchase and refinancing loan applications posted healthy rises in the latest week.

- Effective interest rate on 30-year fixed loans fell to 6.32%.

- Average loan size rose.

- United Kingdom| Jan 21 2026

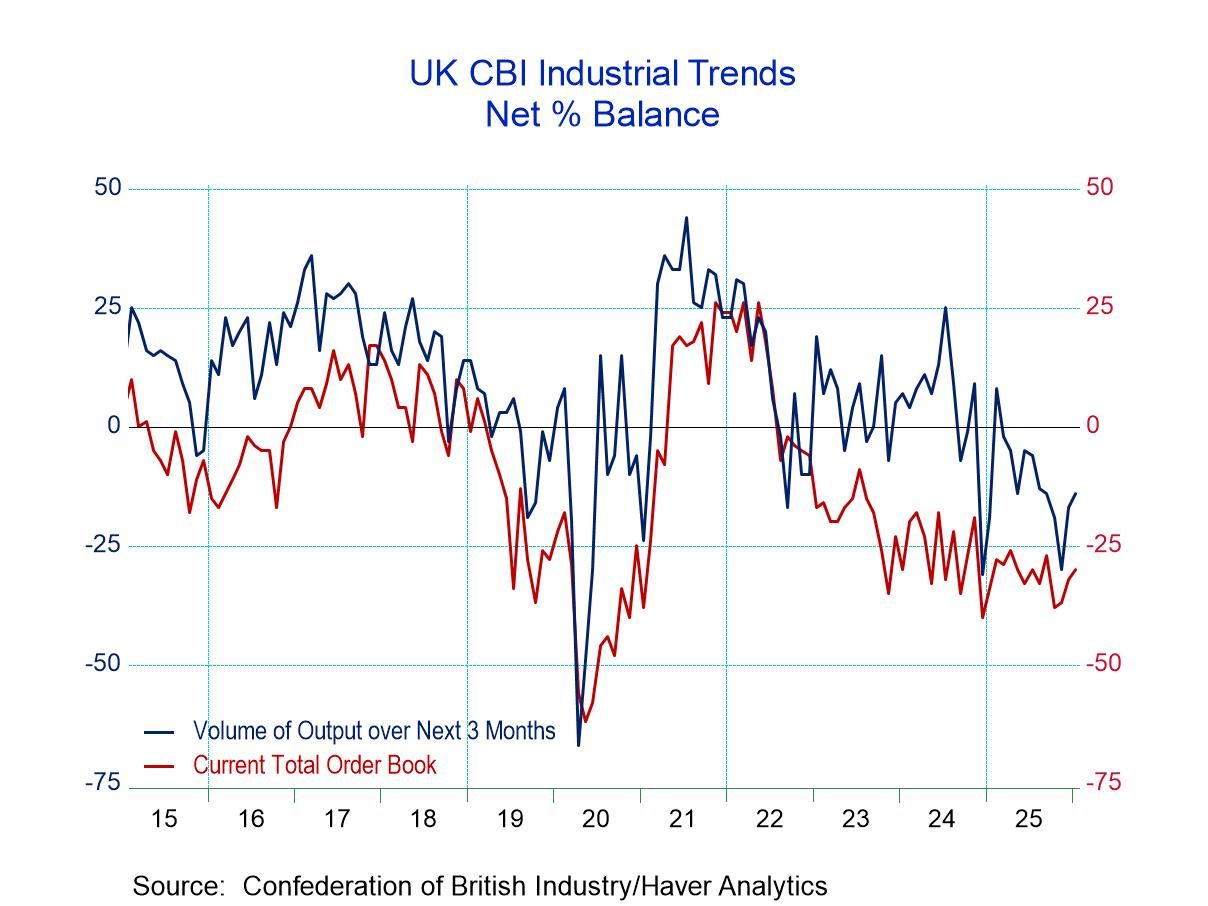

U.K. CBI Industrial Survey Flags Trouble Ahead

The CBI (Confederation of British Industry) Industrial Trends Survey showed slight improvement in orders in January 2026 as the survey reading rose to -30 on a net basis from -32 in December and -37 in November. However, the 12-month average of the order series is -31 and so the improvement compared to conditions that prevailed over the last 12 months is not significant.

Export orders, on the other hand, deteriorated to -30 in January from -27 in December although that reading was slightly better than the -31 print in November. Once again, the -30 reading for January is only slightly better than the 12-month average of -32.

Stock-building slowed in January at +3 compared to +8 in December and +16 in November. That, actually, could be good news suggesting that industries are getting control of their inventories at a time when sales have been weak.

Looking ahead for output volume over the next three months improved to -14 in January from -17 in December and -30 in November, a substantial pick up over this period. But the reading for January at -14 is still slightly more negative than the 12-month average of -11.

The unequivocally stronger reading in the table, unfortunately, is for prices with average prices over the next three months at a +29 net reading, up from +19 in December and up from +7 in November. The reading of +29 in January compares to a 12-month average of +18 indicating a significant pickup compared to conditions that prevailed over the last 12 months.

Evaluating these readings by ranking the queue standings of the net values and data back to 1992 shows total orders have a 20th percentile standing, export orders have a 28.4 percentile standing, while the stocks of finished goods have a 9.8 percentile standing, and expected output - despite its recent improvement - is quite weak with an 8.3 percentile standing. Average prices, on the other hand, are quite strong with a 91.7 percentile standing, indicating that the forces of inflation looking ahead are quite strong despite relatively weak demand and output conditions that are expected.

CBI data compared to annual growth rates in manufacturing and to the manufacturing PMI show rankings actually much better than the CBI survey. The manufacturing PMI has a 53.7 percentile standing that's only on data back over the last four years. The manufacturing production data have a 48.3 percentile standing, which is still very close to its 50-percentile standing, which would be its historic median. So, we have another case here of the accounting data being stronger than the survey data from the CBI. The strength in manufacturing industrial output does not compare favorably with the weakness portrayed in the CBI survey even though the manufacturing data are only up-to-date through November. The CBI data are up-to-date through January. And since CBI data generally show some stability or improvement from November to January, that data time mismatch with industrial production doesn't seem to be the reason for these readings being so vastly different. We’re going to have to keep an eye on other metrics for manufacturing to see which one of these surveys is giving us the best information.

For now, we don't know which of these series is the best and what we're looking at is a CBI series that is touting a great deal of economic weakness and portraying significant increases in prices over the next three months.

Global| Jan 20 2026

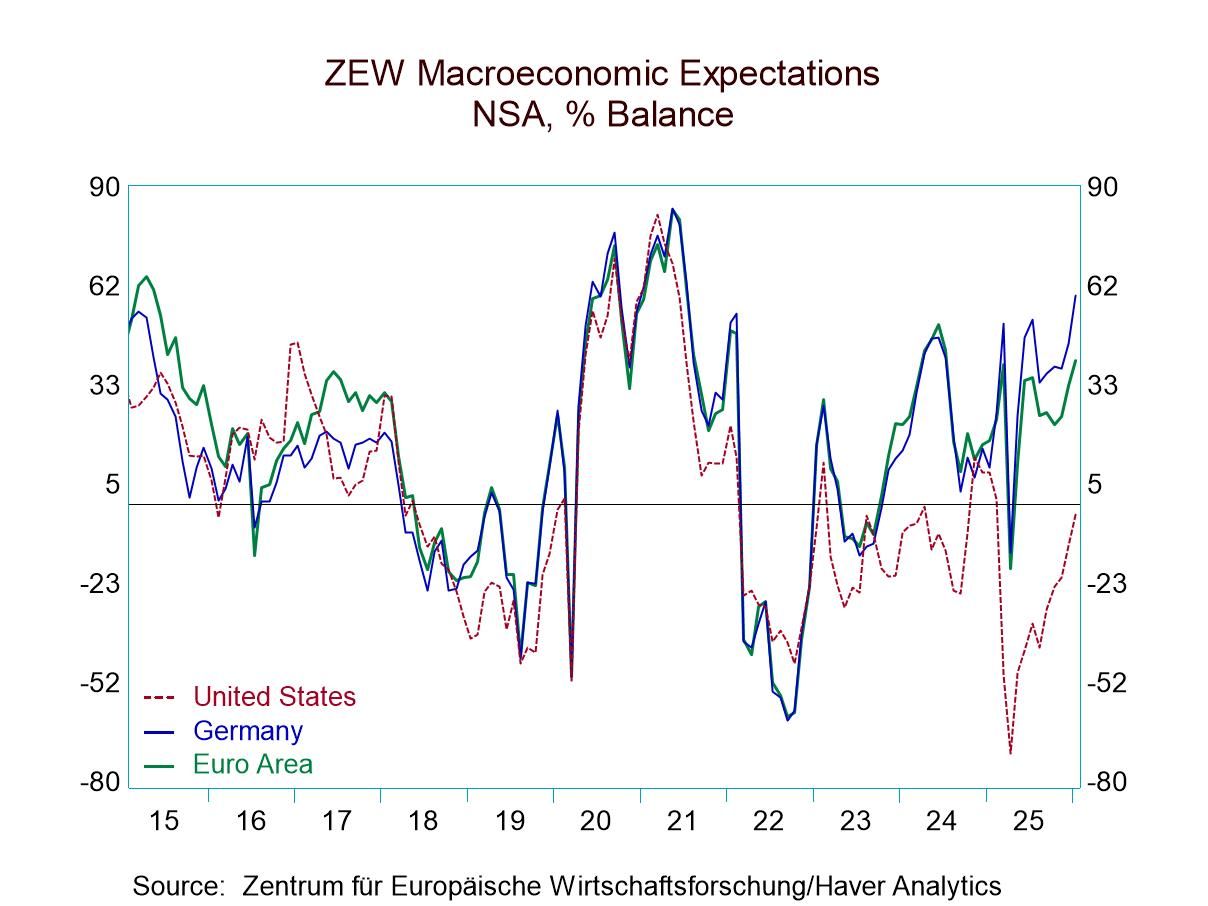

Global| Jan 20 2026ZEW Survey Shows Advancement All Around

The ZEW survey for January showed improvement all around with both economic expectations and macroeconomic conditions showing improvements in the United States, Germany, and the euro area.

The economic situation in January in the euro area improved to a reading of -18.1 from -28.5 in December. In Germany, the reading improved to -72.7 from -81 in December, while in the United States the reading improved to +17.7 from -0.6 in December. The message here clearly is the month-to-month improvement. Still, the January readings leave the assessments of conditions in these three areas as quite different. The percentile-queue standings place each one of these topical readings in their queue of data back to December 1992, expressing the standing in percentile terms. Viewed in this way, the euro area has a 57.2 percentile standing, the U.S. has nearly a 45-percentile standing, while Germany has a 22.6 percentile standing, leaving each of these areas in their own distinctive positions relative to their historic norms. The euro area has a firm and above-median ranking since the reading is above the 50th percentile (where the median is located). The U.S. is slightly weaker than that, with a reading that's marginally below its median. Germany has a reading between the lower quartile and the one-fifth mark of its historic data, branding it as weak.

Macroeconomic expectations find that Germany in January moved up to a positive reading of 59.6 from 45.8 in December. The U.S. also improved, moving up to -3 from -12 in December. The macro-expectations find Germany and the U.S. in very different places with German expectations in an 80.4 percentile of their queue, placing them in the top 20% while the U.S. has a 45-percentile standing, below its historic median and essentially the same relative position as its current situation ranking. In contrast, Germany has a weak current economic assessment versus a stronger expectations assessment.

Inflation expectations weaken across the board in January, with the euro area falling to -7.6 from -4.6 in December, Germany falling to -6.0 from -1.7 and the U.S. falling to 44.2 from 54.9. The ZEW experts see a disinflationary environment, and they see that despite the pickup in current conditions and improved macroeconomic expectations. Expectations in the U.S. have a 61.1 percentile standing; the German and the euro area readings are much weaker and closer together, with the German standing at its 31.2 percentile and the euro area at its 25.8 percentile.

On the back of these expectations, short-term interest rates in the euro area are less weak, with the January reading at -7.7, up from -10.8 in December. The U.S. has a -65.6 reading, stronger than Decembers -73.9. On a ranking basis, the euro area’s short-term rates have a 37.4 percentile standing The U.S. has a 9.3 percentile standing. The interest rate assessment is that short-term rates are going to be modest to lower over the outlook.

Long-term interest rates in Germany and the U.S. weaken slightly in January from December to 44.5 in January for Germany, compared to 49.2 in December, and in the U.S., there is a very modest ‘decimal point’ change to 44.1 in January from 44.9 in December. German long-term rates have a 58.8 percentile standing while the U.S. has rates at about a 50-percentile standing, placing them just about on top of their historic median. Neither one of these expectations has long-term expectations different from historic norms.

Stock market expectations from December to January, however, are little changed and mostly weaker, with the euro area gauge falling to 35.2 from 41.3 in December. The German gauge slips to 35.9 from 36.3 in December. The January gauge for the U.S. is ticking slightly higher to 31.5 January from 30.2 in December. The rankings for the January gauges show the U.S. above its median at a 59.3 percentile mark, the euro area slightly below its median with a 44.9 percentile reading; the German stock market still scores as the weakest at a 39.7 percentile standing.

- of2693Go to 4 page